When it comes to protecting your furry friend, choosing the right pet insurance is crucial. If you’re deciding between Pets Best vs ASPCA Insurance, you’re likely looking for the best coverage, affordability, and service to meet your pet’s needs. In this comprehensive comparison, we’ll break down the key features, pricing, and benefits of both providers to help you make an informed decision and ensure your pet gets the care they deserve. Let’s dive in!

Table of Contents

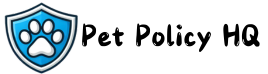

Coverage Options

When it comes to choosing the right pet insurance plan, understanding the coverage options is crucial. Both Pets Best and ASPCA Insurance offer comprehensive plans designed to cover a wide range of health needs for your furry friends. Let’s break down their offerings to help you make an informed decision.

Pets Best Coverage Options

Pets Best provides flexible plans that cater to various pet health requirements. Their main coverage options include:

- Accident and Illness Coverage: Covers treatments for injuries, illnesses, and hereditary conditions.

- Routine Care Add-On: Optional wellness coverage for preventative care, including vaccinations, flea prevention, and dental cleanings.

- Customizable Plans: Choose your deductible, reimbursement rate, and annual limit to fit your budget and needs.

Pets Best stands out for offering no upper age limits for pets, making it an excellent choice for older pets that need coverage.

ASPCA Insurance Coverage Options

ASPCA Insurance also provides robust options to protect your pets. Key coverage features include:

- Complete Coverage Plan: Covers accidents, illnesses, hereditary conditions, and even alternative therapies like acupuncture.

- Preventative Care Add-On: Optional coverage for routine check-ups, vaccinations, and wellness visits.

- Behavioral Issues: ASPCA Insurance includes coverage for behavioral therapies, which is a unique feature not all providers offer.

ASPCA Insurance’s coverage extends to alternative therapies, which could be beneficial if you’re interested in holistic treatment options.

Key Differences

While both providers offer accident and illness coverage, ASPCA Insurance includes behavioral therapy and alternative treatments in their standard plans, making it a strong choice for pet owners seeking more holistic care. On the other hand, Pets Best offers greater flexibility with customizable plans and no age restrictions, which is particularly advantageous for senior pets.

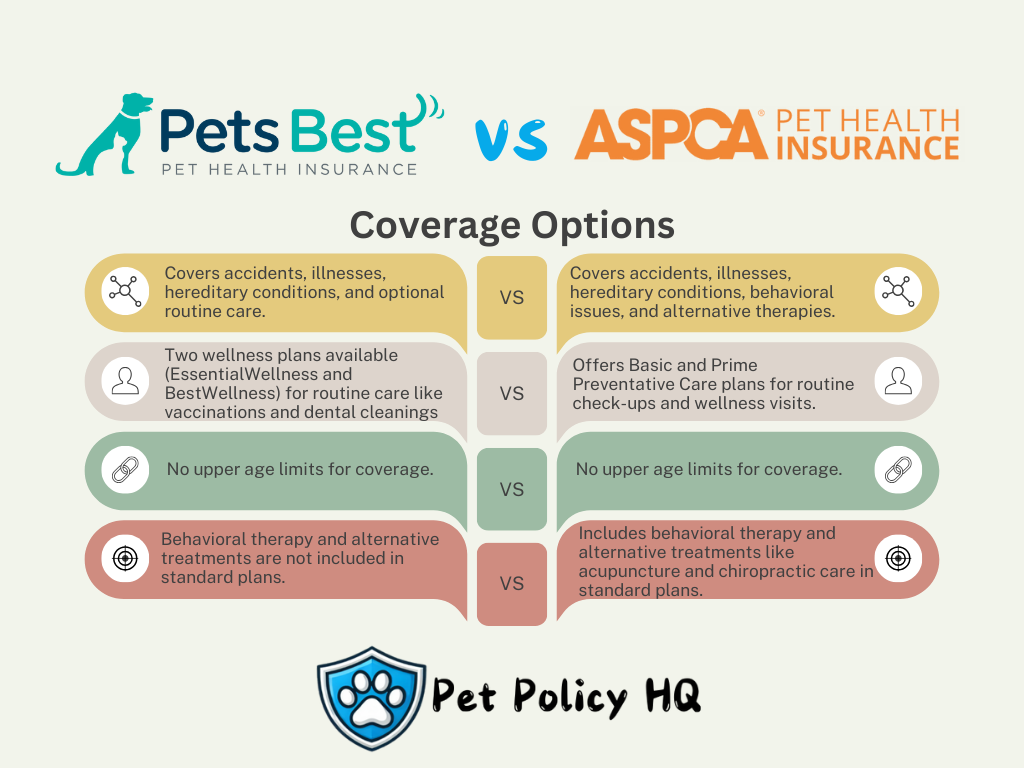

Pricing and Affordability

When selecting pet insurance, pricing and affordability are often top considerations. Comparing the costs of Pets Best vs ASPCA Insurance can help you determine which plan provides the best value for your budget and your pet’s needs.

Pets Best Pricing and Affordability

Pets Best is known for offering flexible pricing options that cater to a wide range of budgets. Key factors include:

- Customizable Plans: Adjust your deductible, annual limit, and reimbursement rate to control monthly premiums.

- Competitive Premiums: Monthly costs generally start as low as $10 for cats and $15 for dogs.

- Routine Care Add-On: Adding wellness coverage increases premiums but provides extra value for preventative care.

- Discounts: Multi-pet discounts are available, making it a cost-effective choice for households with multiple pets.

Pets Best excels in providing affordability through its customization options, allowing pet owners to tailor plans to their financial needs.

ASPCA Insurance Pricing and Affordability

ASPCA Insurance also offers a range of pricing options designed to fit most budgets. Key details include:

- Tiered Plans: Choose from different coverage tiers, each with varying levels of protection and cost.

- Preventative Care Add-On: Similar to Pets Best, this optional coverage increases premiums but includes essential routine care services.

- Average Premiums: Monthly costs typically range from $20 to $50, depending on the level of coverage and your pet’s age, breed, and location.

- Discounts: Offers a 10% multi-pet discount, helping families with more than one pet save on premiums.

ASPCA Insurance provides consistent pricing across its plans, though the premiums may be slightly higher than Pets Best for comparable coverage levels.

Key Differences

When comparing Pets Best vs ASPCA Insurance in terms of pricing:

- Pets Best offers more flexibility, allowing pet owners to adjust premiums through customizable options.

- ASPCA Insurance has slightly higher starting premiums but includes features like behavioral therapy and alternative treatments, which may justify the cost for some pet owners.

Claims Process

The claims process is one of the most important aspects of any pet insurance plan. A smooth and efficient system can make a significant difference when it comes to managing unexpected veterinary bills. Here’s how the claims process for Pets Best vs ASPCA Insurance compares.

Pets Best Claims Process

Pets Best is known for its user-friendly and quick claims process. Key features include:

- Digital Claims Submission: File claims easily through the Pets Best mobile app or online portal.

- Fast Reimbursement Times: Most claims are processed within 5-7 business days.

- Direct Deposit Options: Receive reimbursements quickly via direct deposit.

- Transparent Tracking: Track the status of your claim in real time through their platform.

Pets Best’s claims process is ideal for tech-savvy pet owners who want quick and seamless handling of their insurance claims.

ASPCA Insurance Claims Process

ASPCA Insurance also provides a straightforward claims process that prioritizes accessibility. Key highlights include:

- Multiple Submission Methods: Submit claims via the ASPCA mobile app, online portal, or by email or mail.

- Claim Processing Time: Claims are typically processed within 14-16 business days, slightly longer than Pets Best.

- Reimbursement Options: Choose to receive funds via direct deposit or check.

- Pre-Approval for Treatments: Offers a pre-approval option for high-cost procedures, reducing financial uncertainty.

ASPCA Insurance’s claims process provides flexibility in submission methods but may take longer to process compared to Pets Best.

Key Differences

When comparing the claims process for Pets Best vs ASPCA Insurance:

- Pets Best offers faster processing times, making it a better choice for pet owners needing quick reimbursements.

- ASPCA Insurance provides additional options like pre-approval for costly treatments, which can be beneficial for large veterinary expenses.

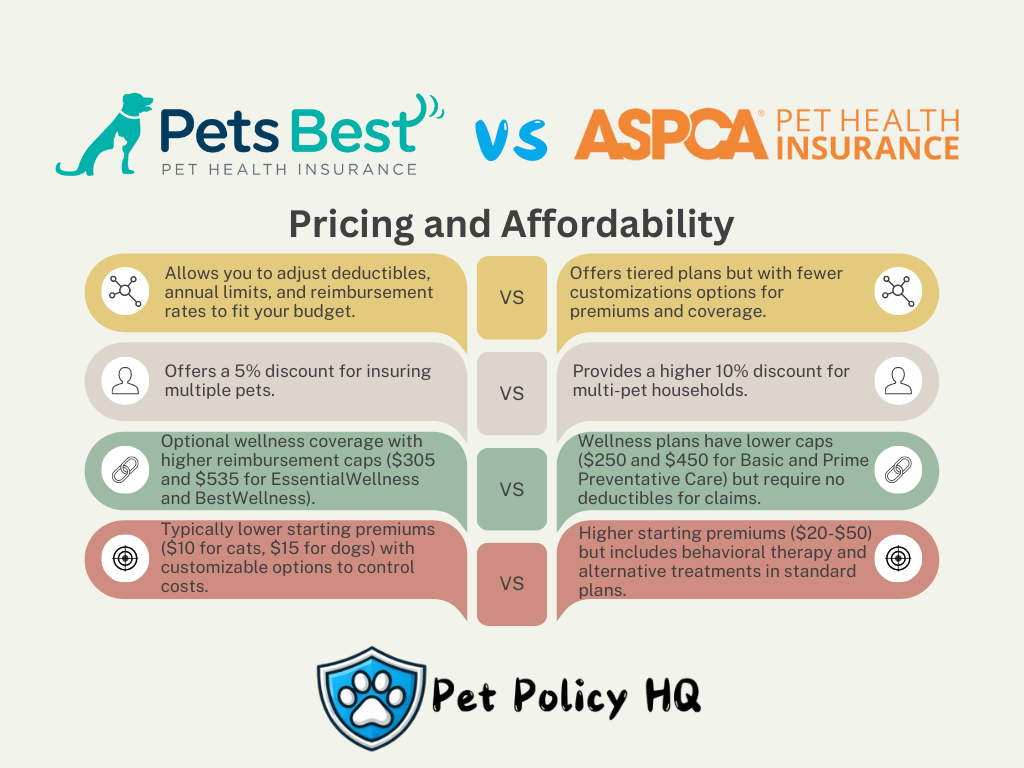

Waiting Periods

Understanding waiting periods is essential when comparing pet insurance options. These are the time frames that must pass after enrollment before coverage begins. Here’s how the waiting periods for Pets Best vs ASPCA Insurance compare.

Pets Best Waiting Periods

Pets Best offers relatively short and straightforward waiting periods for most conditions:

- Accidents: Coverage begins just 3 days after enrollment.

- Illnesses: A 14-day waiting period applies to illnesses.

- Orthopedic Conditions: No additional waiting period for orthopedic issues unless specified by your policy.

- Routine Care Add-On: No waiting period applies to wellness coverage if selected.

The short waiting periods for accidents make Pets Best a strong choice for immediate coverage needs.

ASPCA Insurance Waiting Periods

ASPCA Insurance also has waiting periods designed to prevent fraudulent claims. Key details include:

- Accidents and Illnesses: Coverage begins 14 days after enrollment for both accidents and illnesses.

- Special Conditions: Some conditions, like cruciate ligament issues, may have additional waiting periods as specified in the policy.

- Preventative Care Add-On: No waiting period applies to routine care coverage if purchased.

While ASPCA Insurance’s waiting periods are standard, the 14-day period for accidents is longer compared to Pets Best.

Key Differences

When comparing the waiting periods for Pets Best vs ASPCA Insurance:

- Pets Best has a shorter waiting period for accidents (3 days) compared to ASPCA’s 14 days.

- Both providers have a 14-day waiting period for illnesses, making this aspect evenly matched.

For pet owners seeking quicker accident coverage, Pets Best is the better option, while ASPCA Insurance aligns with industry norms for accidents and illnesses.

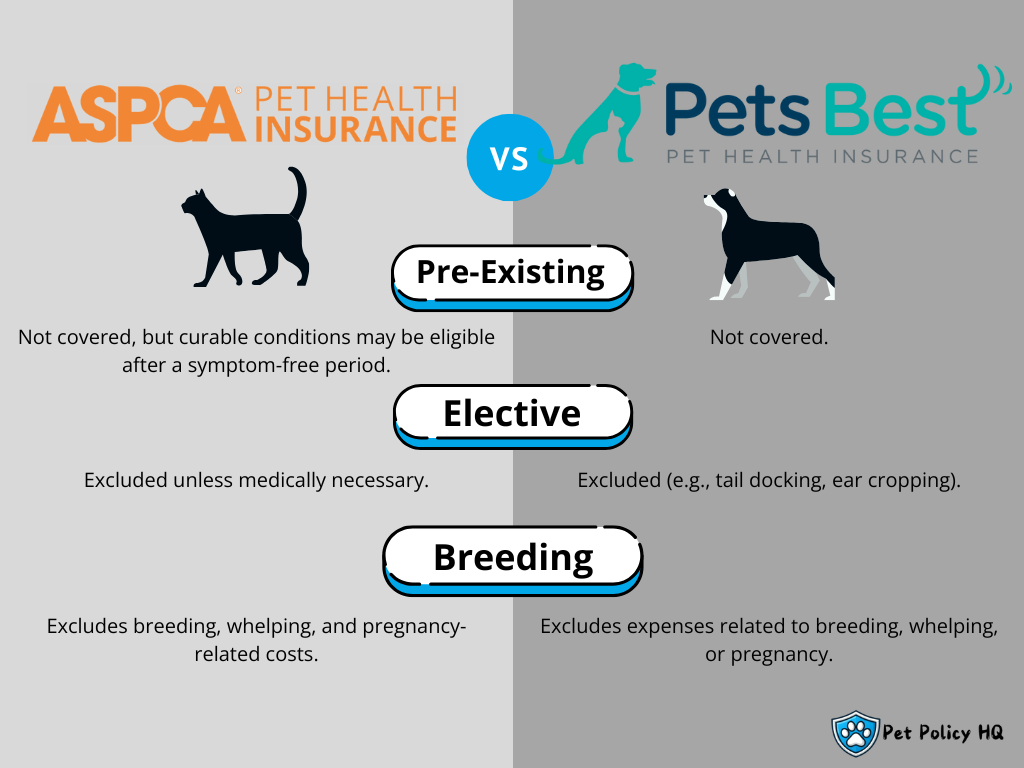

Exclusions

When selecting pet insurance, understanding the exclusions in a policy is critical. Exclusions refer to conditions or treatments that are not covered, and knowing these details can help you make a well-informed decision. Let’s dive into the exclusions for Pets Best vs ASPCA Insurance and what pet owners should consider.

Pets Best Exclusions

Pets Best outlines exclusions clearly in their policies. Key exclusions include:

- Pre-Existing Conditions: Any condition that shows symptoms before enrollment or during the waiting period.

- Elective Procedures: Cosmetic surgeries or procedures like tail docking or ear cropping are not covered.

- Breeding-Related Costs: Expenses related to breeding, whelping, or pregnancy are excluded.

- Experimental Treatments: Treatments not proven effective or considered experimental are not covered.

- Routine Care (unless added): Preventative care, such as vaccinations and dental cleanings, is only covered if the optional wellness add-on is selected.

Pets Best’s exclusions align with industry standards, but the availability of optional wellness plans can cover many routine expenses.

ASPCA Insurance Exclusions

ASPCA Insurance also has a detailed list of exclusions, which include:

- Pre-Existing Conditions: Similar to Pets Best, pre-existing conditions are not covered. However, curable pre-existing conditions may be eligible for future coverage if the pet has been symptom-free for a specified period.

- Cosmetic Procedures: Exclusions include procedures like declawing and tail docking unless medically necessary.

- Breeding Costs: Expenses related to breeding or pregnancy are excluded.

- Experimental or Off-Label Treatments: These treatments are not included in coverage.

- Routine Care (unless added): Routine care is only covered through the optional Preventative Care add-on.

ASPCA Insurance’s unique offering is the possibility of covering curable pre-existing conditions, which can be a game-changer for some pet owners.

Key Differences

When comparing exclusions for Pets Best vs ASPCA Insurance:

- Both providers exclude pre-existing conditions, but ASPCA Insurance may cover curable pre-existing conditions after a waiting period.

- The exclusion lists are generally similar, but specific policy wording and optional add-ons may provide slight advantages depending on your pet’s needs.

Being aware of these exclusions helps pet owners avoid unexpected costs and choose the policy that best fits their situation.

Policy Limits

Policy limits determine the maximum amount a pet insurance provider will reimburse for covered expenses. Understanding the differences in policy limits for Pets Best vs ASPCA Insurance is essential to ensure your pet gets the coverage they need without unexpected out-of-pocket expenses.

Pets Best Policy Limits

Pets Best offers flexible policy limits that cater to a variety of needs:

- Unlimited Annual Coverage: For pet owners seeking maximum protection, Pets Best provides unlimited annual benefit options with no caps on payouts.

- Customizable Limits: Choose from a range of annual coverage limits (e.g., $5,000 or $10,000), allowing you to tailor the plan to your budget and risk tolerance.

- Per-Incident Coverage: Pets Best does not impose per-incident limits, ensuring you can claim up to the annual or unlimited cap for a single illness or injury.

The ability to select unlimited annual coverage makes Pets Best an excellent choice for pet owners concerned about high-cost emergencies.

ASPCA Insurance Policy Limits

ASPCA Insurance also provides a variety of policy limits to suit different financial needs:

- Annual Coverage Limits: Choose from options ranging from $5,000 to unlimited annual coverage.

- Per-Incident Caps: Unlike Pets Best, ASPCA Insurance may impose limits for specific conditions or incidents, depending on the plan.

- Customizable Coverage: Adjust limits to balance affordability and protection for your pet’s needs.

While ASPCA Insurance offers unlimited annual coverage, it’s important to review the fine print for any per-condition caps that may apply.

Key Differences

When comparing policy limits for Pets Best vs ASPCA Insurance:

- Both providers offer unlimited annual coverage as an option, but Pets Best does not impose per-incident limits, giving it an edge for comprehensive protection.

- ASPCA Insurance provides flexibility but may include per-condition caps, which could be a consideration for pets with chronic conditions or recurring issues.

Understanding your pet’s potential healthcare costs will help you choose the right policy limit for your situation.

Wellness Coverage

Wellness coverage is an optional add-on for many pet insurance plans, designed to cover routine and preventative care that helps keep your pet healthy. Let’s compare the wellness coverage for Pets Best vs ASPCA Insurance to see which provider offers the most value.

Pets Best Wellness Coverage

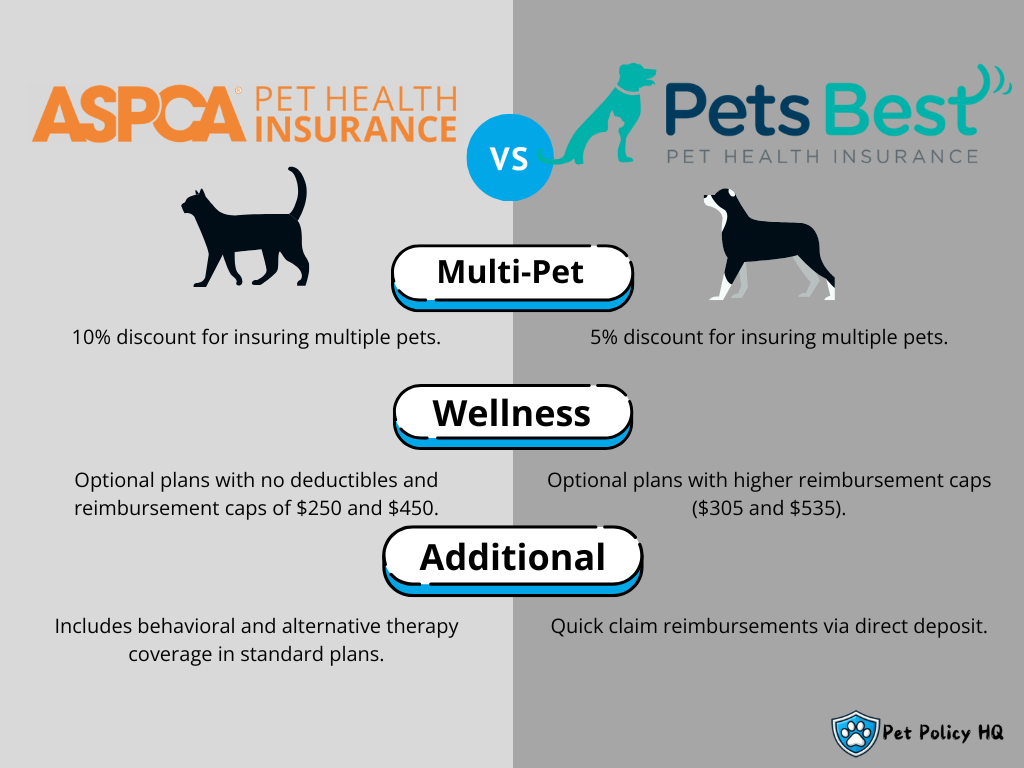

Pets Best offers two optional wellness plans that can be added to their pet insurance policies:

- EssentialWellness: Covers routine care like vaccinations, spaying/neutering, flea prevention, and routine bloodwork, with an annual reimbursement cap of $305.

- BestWellness: Provides expanded coverage for similar services with an annual reimbursement cap of $535.

- No Waiting Period: Wellness coverage starts immediately after enrollment, ensuring you can utilize benefits right away.

These plans are ideal for pet owners who want predictable costs for routine care and preventative treatments.

ASPCA Insurance Wellness Coverage

ASPCA Insurance also provides optional wellness plans as add-ons to their standard policies:

- Basic Preventative Care: Covers essential routine care services like vaccinations, dental cleanings, and wellness exams, with an annual reimbursement cap of $250.

- Prime Preventative Care: Offers broader coverage with a higher annual reimbursement cap of $450.

- No Deductible: Wellness claims do not require a deductible, allowing pet owners to maximize their reimbursements.

ASPCA Insurance’s wellness plans are straightforward, offering a simple way to manage routine care expenses.

Key Differences

When comparing wellness coverage for Pets Best vs ASPCA Insurance:

- Pets Best offers higher reimbursement caps, making it a better choice for pet owners who spend more on routine care.

- ASPCA Insurance provides lower caps but includes a no-deductible feature, which may be appealing for those seeking upfront savings.

- Both providers allow immediate use of wellness benefits, ensuring coverage for routine care without delays.

Choosing the right wellness plan depends on the routine care your pet needs and your budget for preventative health measures.

Network of Veterinarians

When selecting pet insurance, flexibility in choosing your veterinarian is crucial. The network of veterinarians for Pets Best vs ASPCA Insurance plays a significant role in determining how easily you can access care for your pet.

Pets Best Network of Veterinarians

Pets Best stands out for its extensive and flexible approach:

- No Network Restrictions: Pets Best allows you to visit any licensed veterinarian in the United States or Canada.

- Specialist and Emergency Care: Coverage extends to veterinary specialists and emergency clinics, providing peace of mind during urgent situations.

- Reimbursement Model: Rather than direct payment, you pay the vet upfront and file a claim for reimbursement, which means no need to worry about whether your vet is “in-network.”

Pets Best’s open network policy ensures you’re not limited in your choice of veterinary care providers, making it convenient for pet owners who already have a trusted vet.

ASPCA Insurance Network of Veterinarians

ASPCA Insurance also offers significant flexibility in choosing your veterinarian:

- No Network Restrictions: Like Pets Best, ASPCA Insurance allows you to visit any licensed veterinarian in the United States or Canada.

- Direct Pay Option: Some vets may offer direct billing to ASPCA Insurance, reducing upfront costs for pet owners.

- Emergency and Specialist Care: Coverage includes emergency clinics and specialist visits, ensuring comprehensive care options.

The option for direct pay at certain veterinary offices can be a valuable feature for pet owners managing high upfront costs.

Key Differences

When comparing the network of veterinarians for Pets Best vs ASPCA Insurance:

- Both providers offer unrestricted access to any licensed vet, making them equally flexible in this regard.

- ASPCA Insurance’s occasional direct pay option provides an edge for pet owners looking to minimize out-of-pocket expenses.

Ultimately, both providers excel in offering pet owners the freedom to choose their preferred veterinarian without worrying about network restrictions.

Customer Service and Support

Reliable customer service is essential when dealing with pet insurance, as you want prompt and helpful assistance whenever you need it. Comparing the customer service and support for Pets Best vs ASPCA Insurance can help you decide which provider offers a better experience.

Pets Best Customer Service and Support

Pets Best is known for providing efficient and accessible customer support. Key features include:

- Multiple Contact Channels: Reach their support team via phone, email, or live chat.

- Extended Hours: Customer service is available Monday through Friday, with additional hours on Saturday to accommodate busy schedules.

- User-Friendly Portal: Their online portal and mobile app allow easy management of claims, policy details, and reimbursements without needing to contact support.

- Knowledge Base: An extensive FAQ section on their website provides answers to common questions.

Pets Best earns high marks for its robust digital tools and responsive customer service, making it easy to resolve issues quickly.

ASPCA Insurance Customer Service and Support

ASPCA Insurance also offers strong customer support options designed to assist pet owners effectively:

- Multiple Contact Channels: Support is available through phone, email, and their mobile app.

- Extended Hours: ASPCA’s customer service team is available seven days a week, ensuring assistance even on weekends.

- Mobile App Features: The app allows policyholders to file claims, track reimbursements, and access plan information.

- Educational Resources: ASPCA Insurance provides helpful resources on pet care and insurance basics, enhancing the customer experience.

ASPCA Insurance stands out for its seven-day-a-week availability, making it convenient for pet owners needing support on weekends.

Key Differences

When comparing the customer service and support for Pets Best vs ASPCA Insurance:

- Availability: ASPCA Insurance’s seven-day support offers an advantage over Pets Best’s limited weekend hours.

- Digital Tools: Both providers offer robust mobile apps and online portals for managing policies and claims.

- Resources: ASPCA Insurance includes additional educational materials, while Pets Best focuses on a streamlined FAQ and knowledge base.

Both providers excel in offering responsive and accessible support, but ASPCA’s availability on weekends may make it a better choice for those requiring more flexible assistance.

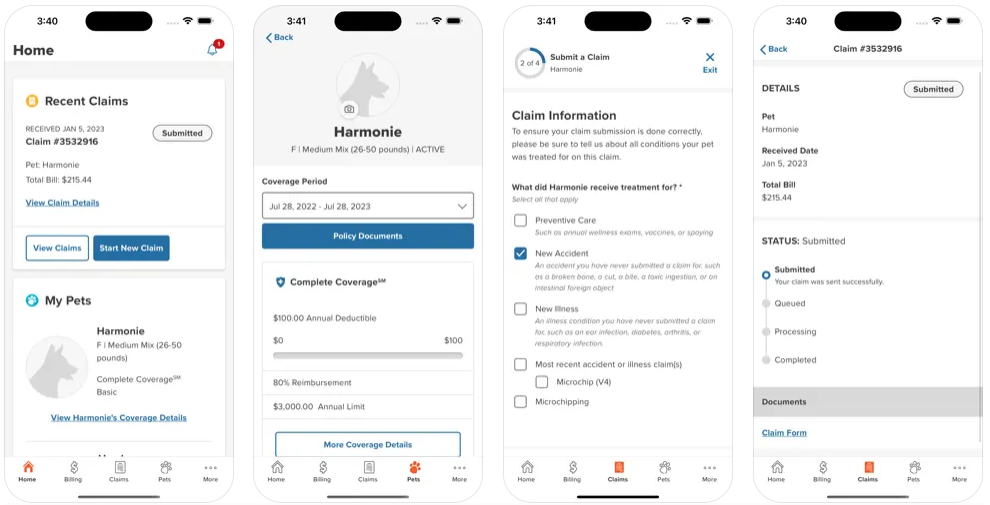

Mobile App and Online Tools

In today’s digital age, having a reliable mobile app and online tools can make managing pet insurance easier and more convenient. Comparing the mobile app and online tools for Pets Best vs ASPCA Insurance highlights the strengths and features each provider offers.

Pets Best Mobile App and Online Tools

Pets Best provides robust digital solutions to simplify policy management:

- Mobile App Features: The Pets Best app allows users to:

- File claims with a few taps by uploading documents and receipts.

- Track claim status and reimbursements in real time.

- Access policy details and billing information.

- Set up direct deposit for faster reimbursements.

- Online Portal: The web-based portal mirrors the app’s functionality, offering a seamless experience across devices.

- User-Friendly Interface: Both the app and portal are intuitive and easy to navigate, making them suitable for all users.

Pets Best excels in providing a straightforward and efficient digital experience for policyholders, ensuring they can manage everything from their phones or computers.

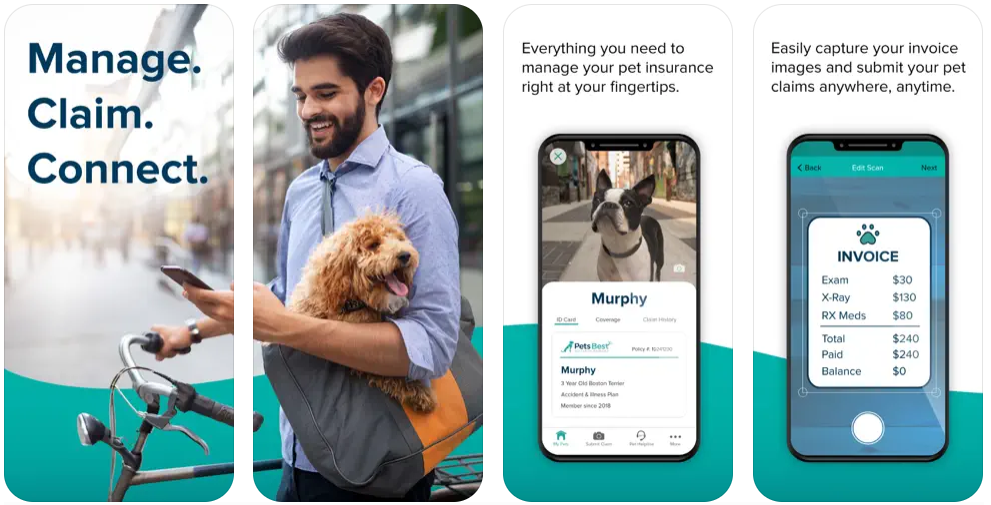

ASPCA Insurance Mobile App and Online Tools

ASPCA Insurance also offers a well-designed mobile app and online tools for managing pet insurance:

- Mobile App Features: The ASPCA Insurance app includes:

- Simple claim submission with photo uploads.

- Policy and coverage management tools.

- Reimbursement tracking and payment history access.

- Educational resources about pet care and insurance.

- Online Portal: The online portal complements the app, enabling users to manage their account and access documents easily.

- Educational Content: Unique to ASPCA Insurance, the app and portal include articles and tips for better pet care, enhancing the value of their digital tools.

ASPCA Insurance’s app adds extra value with its educational resources, which may appeal to first-time pet owners or those looking for additional guidance.

Key Differences

When comparing the mobile app and online tools for Pets Best vs ASPCA Insurance:

- Functionality: Both apps provide essential tools for claim submission, tracking, and policy management.

- Extra Features: ASPCA Insurance stands out for including educational resources, while Pets Best focuses on streamlined claims and reimbursement processes.

- Ease of Use: Both providers offer user-friendly interfaces, but specific preferences may depend on individual needs.

Both apps make managing pet insurance convenient, but ASPCA’s additional resources may give it a slight edge for pet owners seeking a more comprehensive digital experience.

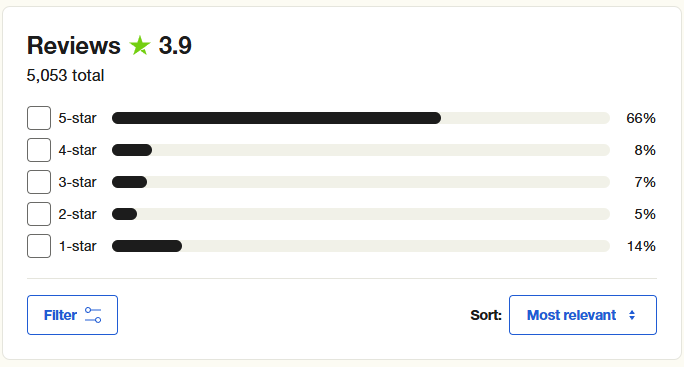

Reputation and Customer Reviews

When choosing pet insurance, the experiences of other pet owners can provide valuable insights. Evaluating the reputation and customer reviews for Pets Best vs ASPCA Insurance helps you understand how these companies perform in real-life scenarios and what to expect as a policyholder.

Pets Best Reputation and Customer Reviews

Pets Best has built a strong reputation for its user-friendly services and quick claim processing. Here are some key highlights:

- Customer Ratings: Pets Best receives positive reviews on platforms like Trustpilot and Consumer Affairs, often praised for its straightforward claims process and reliable reimbursements.

- Top Features Highlighted by Customers:

- Fast claim processing times.

- Flexibility in customizing coverage and pricing.

- Easy-to-use mobile app and online tools.

- Common Complaints: Some customers mention challenges with claim denials for pre-existing conditions or confusion around policy fine print.

Overall, Pets Best is favored for its efficiency and ease of use, making it a top choice for many pet owners.

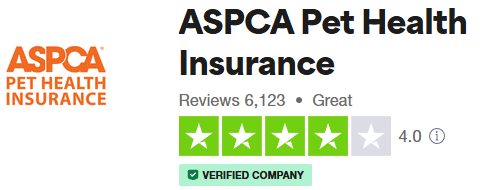

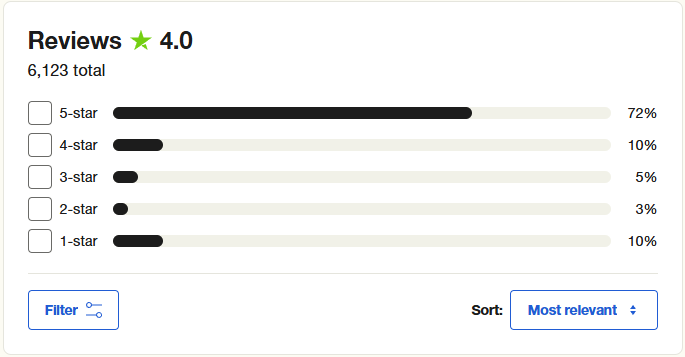

ASPCA Insurance Reputation and Customer Reviews

ASPCA Insurance is well-regarded for its association with the ASPCA and its commitment to pet welfare. Customer feedback reflects these strengths:

- Customer Ratings: ASPCA Insurance garners positive reviews on platforms like Better Business Bureau (BBB) and Trustpilot. Customers appreciate its comprehensive coverage options and responsive customer service.

- Top Features Highlighted by Customers:

- Compassionate and helpful customer support.

- Availability of unique coverage options like behavioral therapies.

- Educational resources within the app and website.

- Common Complaints: Some policyholders report delays in claim processing or misunderstandings about what’s covered, particularly regarding pre-existing conditions.

ASPCA Insurance’s reputation is bolstered by its long-standing association with the ASPCA, fostering trust and credibility among pet owners.

Key Differences

When comparing the reputation and customer reviews for Pets Best vs ASPCA Insurance:

- Pets Best is frequently praised for its quick claims process and customizable plans, appealing to tech-savvy and budget-conscious pet owners.

- ASPCA Insurance stands out for its compassionate service and ties to the ASPCA, which may attract pet owners seeking a company with a strong mission-driven background.

Both providers have positive reputations, but your choice may depend on which features or values align most closely with your needs.

Discounts and Perks

When comparing pet insurance providers, discounts and additional perks can significantly impact overall affordability and value. Let’s evaluate the discounts and perks for Pets Best vs ASPCA Insurance to see how they help pet owners save money while enjoying extra benefits.

Pets Best Discounts and Perks

Pets Best offers several ways to save and provides added perks for policyholders:

- Multi-Pet Discount: Receive a 5% discount when insuring multiple pets under the same policy.

- Employer Benefits Program: Some employers partner with Pets Best to provide discounted rates as an employee benefit.

- Customizable Plans: While not a direct discount, the ability to adjust your coverage, deductible, and reimbursement rate helps control premium costs.

- Quick Reimbursement: Pets Best’s fast claim processing and direct deposit options ensure you get your money back sooner, reducing the financial strain of vet bills.

These discounts and perks make Pets Best a great option for households with multiple pets or those looking to customize their plan for affordability.

ASPCA Insurance Discounts and Perks

ASPCA Insurance also offers valuable discounts and unique perks that appeal to pet owners:

- Multi-Pet Discount: Enjoy a 10% discount for insuring more than one pet, making it one of the better multi-pet discounts available.

- No-Deductible Wellness Claims: Wellness plans do not require a deductible, allowing you to maximize your savings on routine care.

- Association with ASPCA: A portion of the proceeds from ASPCA Insurance supports the ASPCA’s mission to protect animal welfare, making it a meaningful choice for pet owners who want their dollars to contribute to a cause.

- Educational Resources: The ASPCA Insurance app and website offer tips and guides to help pet owners better care for their pets.

ASPCA Insurance’s commitment to animal welfare and no-deductible wellness claims provide unique perks beyond just financial savings.

Key Differences

When comparing the discounts and perks for Pets Best vs ASPCA Insurance:

- Pets Best offers a lower multi-pet discount (5%), but its customizable plans provide flexibility in managing costs.

- ASPCA Insurance has a higher multi-pet discount (10%) and the added value of contributing to the ASPCA’s animal welfare initiatives.

Both providers offer discounts and perks that cater to different priorities, whether you’re looking to save on premiums or support a cause.

Company History and Credibility

When selecting a pet insurance provider, understanding their history and credibility can offer valuable insights into their reliability and trustworthiness. Let’s compare the company history and credibility for Pets Best vs ASPCA Insurance to see how each stacks up.

Pets Best Company History and Credibility

Pets Best was founded in 2005 by Dr. Jack Stephens, a veterinarian credited with starting the pet insurance industry in the United States. Highlights of its history and reputation include:

- Founder’s Expertise: Dr. Stephens launched Pets Best to provide straightforward and reliable pet insurance after decades of veterinary experience.

- Mission-Driven Approach: Pets Best aims to eliminate financial barriers to veterinary care, focusing on providing affordable and customizable plans.

- Recognition and Awards: Pets Best has consistently received high ratings for customer satisfaction and claim processing.

- Trusted Partner: It works with thousands of veterinarians across the U.S. and Canada, further cementing its credibility in the pet care industry.

Pets Best’s solid foundation and commitment to innovation make it a reputable choice for pet owners seeking a reliable insurer.

ASPCA Insurance Company History and Credibility

ASPCA Insurance is backed by the American Society for the Prevention of Cruelty to Animals (ASPCA), which has been advocating for animal welfare since 1866. Key points about its history and credibility include:

- Longstanding Advocacy: The ASPCA’s trusted name and reputation lend significant credibility to its insurance offerings.

- Administered by Crum & Forster Pet Insurance Group: This group has been providing pet insurance for over 20 years, combining experience with the ASPCA’s mission-driven approach.

- Mission Alignment: A portion of ASPCA Insurance proceeds goes toward supporting animal welfare programs, adding a philanthropic value to its coverage.

- Trusted Brand: ASPCA Insurance is known for its commitment to helping pet owners manage unexpected veterinary costs while promoting animal health and safety.

ASPCA Insurance’s deep ties to the ASPCA and its mission-driven ethos resonate strongly with pet owners who value supporting a reputable organization.

Key Differences

When comparing the company history and credibility for Pets Best vs ASPCA Insurance:

- Pets Best is known for its strong foundation in veterinary expertise and customer-centric approach.

- ASPCA Insurance benefits from its association with the ASPCA and its long-standing commitment to animal welfare.

Both companies have strong reputations, but your preference may depend on whether you prioritize industry expertise or supporting a mission-driven organization.

Unique Features

Pet insurance providers often offer distinctive features that set them apart from the competition. Exploring the unique features of Pets Best vs ASPCA Insurance can help you identify which provider offers benefits that best align with your pet’s needs and your preferences.

Pets Best Unique Features

Pets Best focuses on flexibility and efficiency, providing features that cater to a wide range of pet owners:

- Customizable Plans: Pets Best allows you to choose your deductible, annual limit, and reimbursement rate, giving you control over your premiums.

- Direct Deposit for Reimbursements: Receive claims reimbursements quickly through direct deposit, often within 5-7 business days.

- No Upper Age Limits: Pets Best insures pets of all ages, making it an excellent choice for senior pets who may be excluded by other providers.

- Optional Wellness Coverage: Two wellness plans are available to cover routine care like vaccinations, dental cleanings, and flea prevention.

- Dedicated Cat Plans: Pets Best offers special coverage plans tailored specifically for cats, addressing common feline health concerns.

These features make Pets Best an appealing choice for pet owners looking for tailored, fast, and comprehensive insurance.

ASPCA Insurance Unique Features

ASPCA Insurance stands out for its commitment to pet welfare and unique coverage options:

- Behavioral Therapy Coverage: ASPCA Insurance includes behavioral therapy in its standard plans, which is a rare feature in the pet insurance industry.

- Alternative Therapies: Coverage for acupuncture, chiropractic care, and other holistic treatments is included in many plans.

- Curable Pre-Existing Conditions: Some pre-existing conditions may be eligible for future coverage if the pet remains symptom-free for a specified period.

- Mission-Driven Approach: A portion of proceeds supports the ASPCA’s animal welfare initiatives, allowing policyholders to contribute to a meaningful cause.

- Educational Resources: The ASPCA Insurance app and website offer a wealth of information on pet health and insurance, adding value beyond the policy itself.

These unique features make ASPCA Insurance a great option for pet owners seeking comprehensive coverage with a mission-driven focus.

Key Differences

When comparing the unique features of Pets Best vs ASPCA Insurance:

- Pets Best excels in flexibility, quick reimbursements, and tailored coverage options like cat-specific plans.

- ASPCA Insurance stands out for its inclusion of alternative therapies, behavioral coverage, and its philanthropic association with the ASPCA.

The choice between the two will depend on whether you value customizable plans or specialized and mission-driven features.

Pros and Cons of Each

Comparing the pros and cons of Pets Best vs ASPCA Insurance provides a balanced view of what each provider offers. This analysis helps you weigh the strengths and weaknesses of each insurer to decide which one aligns best with your pet’s needs and your budget.

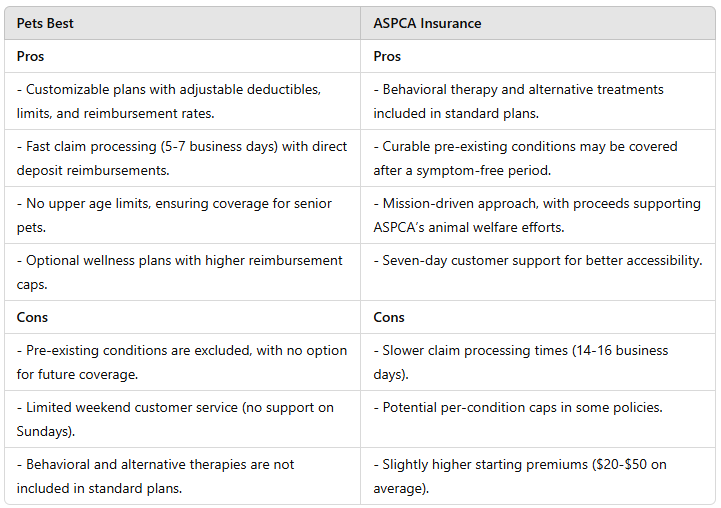

Pets Best Pros and Cons

Pros:

- Customizable Plans: Flexible options for deductibles, annual limits, and reimbursement rates make it easy to tailor coverage to your budget.

- Fast Claim Processing: Reimbursements are typically processed within 5-7 business days, ensuring quick access to funds.

- No Age Limits: Covers pets of all ages, making it a strong choice for senior pets.

- Optional Wellness Coverage: Two wellness plans cover routine care like vaccinations and dental cleanings.

- Dedicated Cat Plans: Special plans focus on common feline health concerns.

Cons:

- Pre-Existing Conditions Not Covered: Like most providers, Pets Best excludes pre-existing conditions, which can be limiting for pets with a medical history.

- Limited Weekend Customer Support: Customer service is not available on Sundays, which could be inconvenient for some pet owners.

ASPCA Insurance Pros and Cons

Pros:

- Behavioral Therapy Coverage: Includes coverage for behavioral treatments, which is rare in the pet insurance industry.

- Alternative Therapies: Offers coverage for acupuncture, chiropractic care, and other holistic treatments.

- Curable Pre-Existing Conditions: Some pre-existing conditions may be eligible for future coverage if your pet remains symptom-free.

- Mission-Driven Approach: A portion of proceeds supports the ASPCA’s animal welfare programs, adding philanthropic value to your policy.

- Seven-Day Customer Support: Customer service is available every day of the week, including weekends.

Cons:

- Longer Claim Processing Times: Claims may take 14-16 business days to process, which is slower than Pets Best.

- Potential Per-Condition Caps: Some policies may impose limits for specific conditions, which could restrict reimbursement for chronic issues.

Key Differences

When comparing the pros and cons of Pets Best vs ASPCA Insurance:

- Pets Best excels in flexibility, speed, and specialized coverage for cats, making it a great choice for pet owners seeking customizable and efficient plans.

- ASPCA Insurance stands out for its holistic coverage options, mission-driven ethos, and seven-day customer support, appealing to pet owners who value comprehensive care and social impact.

Conclusion and Recommendation

Choosing between Pets Best vs ASPCA Insurance ultimately depends on your pet’s needs, your budget, and the features you prioritize in a pet insurance provider. Both companies offer strong options, but they cater to slightly different preferences.

Key Takeaways

- Pets Best is an excellent choice for pet owners looking for flexibility, fast claim processing, and coverage for pets of all ages, including seniors. Its customizable plans and optional wellness coverage make it ideal for tailoring insurance to specific needs.

- ASPCA Insurance stands out for its inclusion of behavioral and alternative therapies, as well as its mission-driven approach that supports the ASPCA’s animal welfare initiatives. Its no-deductible wellness claims and seven-day customer support add additional value.

Who Should Choose Pets Best?

- Pet owners who value fast claim processing.

- Those who need insurance for senior pets.

- People looking for customizable plans to control costs.

Who Should Choose ASPCA Insurance?

- Pet owners seeking comprehensive coverage for behavioral and alternative therapies.

- Those who value a mission-driven provider contributing to animal welfare.

- People needing customer support availability on weekends.

Both Pets Best and ASPCA Insurance are reputable providers with unique strengths. To make the best decision, consider your pet’s health needs, your financial situation, and the features you value most. Getting quotes from both providers and comparing them side by side can help you finalize your choice.