Choosing the right pet insurance can be overwhelming, especially when comparing top providers like Pets Best vs Spot Pet Insurance. Both companies offer valuable protection for your furry friends, but their plans, features, and pricing differ in ways that can significantly impact your decision. In this guide, we’ll provide an in-depth comparison of these two providers, breaking down their strengths and weaknesses to help you choose the best coverage for your pet’s needs and your budget.

Table of Contents

Coverage Options

When comparing Pets Best vs Spot Pet Insurance, understanding their coverage options is crucial to choosing the right policy for your pet. Both providers offer a range of plans, but their inclusions, exclusions, and flexibility can vary significantly. Let’s break it down.

Types of Plans Offered

- Pets Best: Offers three primary types of plans:

- Accident-Only Coverage: Covers unexpected injuries like broken bones or poisoning.

- Accident and Illness Coverage: Includes accidents as well as illnesses such as cancer, allergies, and infections.

- Wellness Plans (optional add-ons): Helps cover routine care like vaccinations, dental cleanings, and annual exams.

- Spot Pet Insurance: Provides two main plans:

- Accident-Only Coverage: Similar to Pets Best, focusing solely on injuries.

- Accident and Illness Coverage: Covers both emergencies and illnesses.

- Offers wellness options as add-ons for routine and preventive care.

What’s Included

- Both providers cover:

- Diagnostic tests (e.g., X-rays, MRIs, blood tests)

- Surgery and hospitalization

- Chronic conditions (e.g., arthritis, diabetes)

- Prescription medications

- Key Differences:

- Pets Best: Covers prosthetic devices and wheelchairs, which is a unique offering.

- Spot: Includes alternative therapies like acupuncture and chiropractic care, appealing to pet owners seeking holistic treatment options.

Exclusions

- Both providers exclude:

- Pre-existing conditions (though some curable conditions may be covered if symptom-free for a specific period)

- Cosmetic procedures (e.g., tail docking, ear cropping)

- Breeding or pregnancy-related expenses

Flexibility and Customization

- Pets Best offers more plan flexibility with varying levels of annual limits, deductibles, and reimbursement percentages. This makes it easier to tailor the plan to fit your budget.

- Spot keeps things simpler but still allows customization of deductibles and reimbursement rates, though its plan options are slightly less extensive than Pets Best.

Cost and Pricing

When evaluating Spot Pet vs Pets Best Insurance, cost is one of the most critical factors for pet owners. Both providers aim to offer competitive pricing, but their premiums, deductibles, and additional fees differ, impacting affordability. Here’s a detailed comparison of their cost structures.

Monthly Premiums

- Pets Best: Premiums start at around $9 per month for accident-only coverage and go up depending on the plan’s comprehensiveness and your pet’s age, breed, and location. Comprehensive accident and illness plans typically cost between $30 to $50 per month.

- Spot Pet Insurance: Monthly premiums also begin at approximately $10 for accident-only plans, with more comprehensive plans ranging between $25 and $55 per month. Spot is often slightly more affordable for younger pets.

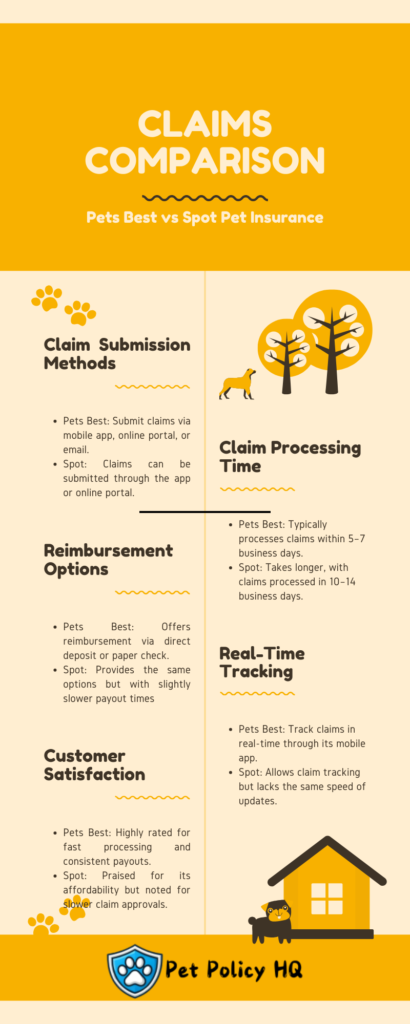

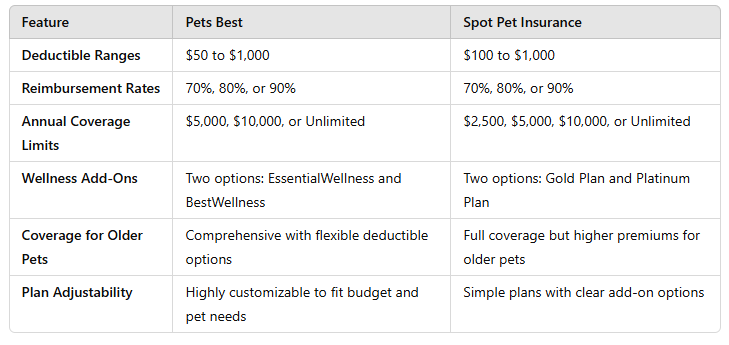

Deductibles

- Pets Best: Offers flexible annual deductibles ranging from $50 to $1,000, allowing you to customize your plan to fit your budget. Lower deductibles mean higher premiums but less out-of-pocket expense per claim.

- Spot: Provides similar flexibility, with deductible options starting at $100 and going up to $1,000. The range allows pet owners to choose a balance between upfront costs and monthly payments.

Reimbursement Rates

- Both providers allow you to select reimbursement rates of 70%, 80%, or 90% of eligible expenses.

- Pets Best: Slightly more customizable in terms of payout options, making it easier to adjust to your financial needs.

- Spot: Offers comparable rates but sometimes includes caps for specific treatments in certain plans.

Hidden Fees or Charges

- Pets Best: Generally transparent with costs and does not charge an enrollment fee.

- Spot: Occasionally includes a small enrollment fee during sign-up, but this depends on promotions and the selected plan.

Overall Value

- Pets Best: A good option for pet owners who want a highly customizable plan and don’t mind slightly higher premiums for older pets or those with extensive coverage needs.

- Spot: More appealing to younger pet owners or those who want affordable accident-only or basic plans.

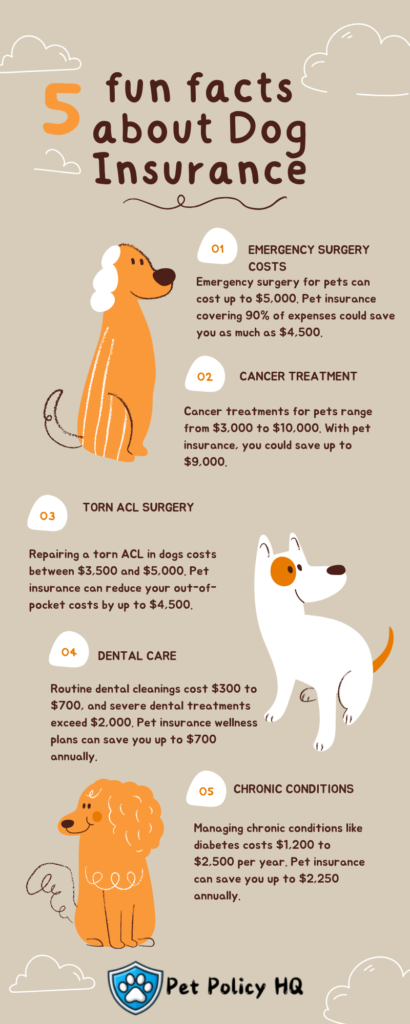

Claim Process and Payouts

The claims process is a critical factor when comparing Pets Best vs Spot Pet Insurance. Pet owners want a straightforward, quick, and reliable way to get reimbursed for their expenses. Here’s how these two providers compare in terms of filing claims and receiving payouts.

Ease of Filing Claims

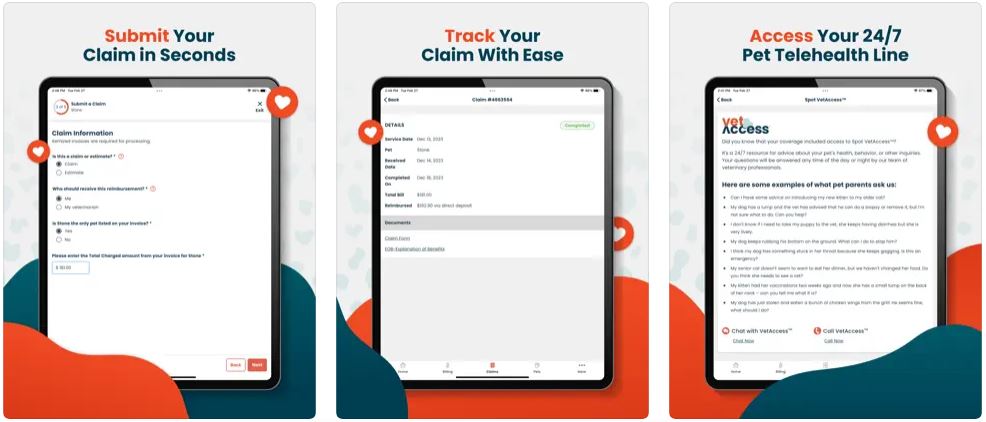

- Pets Best: Offers multiple claim submission methods, including a user-friendly online portal and mobile app. You can upload invoices directly, making the process convenient.

- Spot Pet Insurance: Similarly, Spot provides an intuitive mobile app and online portal for claim submissions. The process is straightforward and doesn’t require extensive paperwork.

Claim Approval Timelines

- Pets Best: Typically processes claims within 5 to 7 business days, depending on the complexity of the claim. Faster processing is available for direct deposit users.

- Spot: Claims are usually processed within 10 to 14 business days, which is slightly slower than Pets Best. However, Spot focuses on accuracy to ensure fewer disputes or errors.

Payout Methods

- Pets Best: Offers reimbursements via direct deposit or paper check. Direct deposit is the faster option, with funds often available within a few days after claim approval.

- Spot: Also provides direct deposit and paper check options, but the overall timeline for receiving funds tends to be a bit longer compared to Pets Best.

Customer Satisfaction with Claims

- Pets Best: Highly rated for its speedy claims process and consistent payouts. Customers appreciate the transparency and updates during the approval process.

- Spot: While accurate in processing claims, some customers note occasional delays. However, Spot is often praised for its helpful customer service team when issues arise.

Special Features

- Pets Best: Includes a pre-authorization option for costly treatments, allowing pet owners to understand coverage before incurring significant expenses.

- Spot: Offers educational resources during the claims process to help pet owners better understand what’s covered and why.

Customer Reviews and Ratings

Customer feedback plays a significant role in deciding between Pets Best vs Spot Pet Insurance. Reviews and ratings give insight into real pet owners’ experiences with coverage, claims, and customer service. Let’s explore how these two providers fare in customer sentiment.

Pets Best Customer Reviews

- Overall Sentiment: Pets Best generally receives positive reviews for its customizable plans, quick claims processing, and transparent communication.

- Common Praises:

- Fast reimbursement for claims submitted via direct deposit.

- User-friendly mobile app and online portal for managing policies.

- Flexibility in plan options, catering to various budgets and pet needs.

- Common Complaints:

- Higher premiums for older pets.

- Strict exclusions for pre-existing conditions, similar to industry standards.

- Occasional delays in claim processing for more complex cases.

Spot Pet Insurance Customer Reviews

- Overall Sentiment: Spot is well-regarded for its affordable accident-only plans and coverage for alternative therapies, but reviews highlight some mixed experiences with claims timelines.

- Common Praises:

- Affordable premiums for young pets and basic coverage needs.

- Coverage for holistic treatments like acupuncture and chiropractic care.

- Helpful customer service team for resolving questions or concerns.

- Common Complaints:

- Longer claim processing times compared to Pets Best.

- Issues with claim denials for unclear policy exclusions.

- Some pet owners find the waiting periods restrictive.

Ratings from Review Platforms

- Pets Best:

- Rated 3.9/5 on Trustpilot based on consistent payouts and ease of claims.

- Strong BBB (Better Business Bureau) rating, indicating reliability and a commitment to resolving complaints.

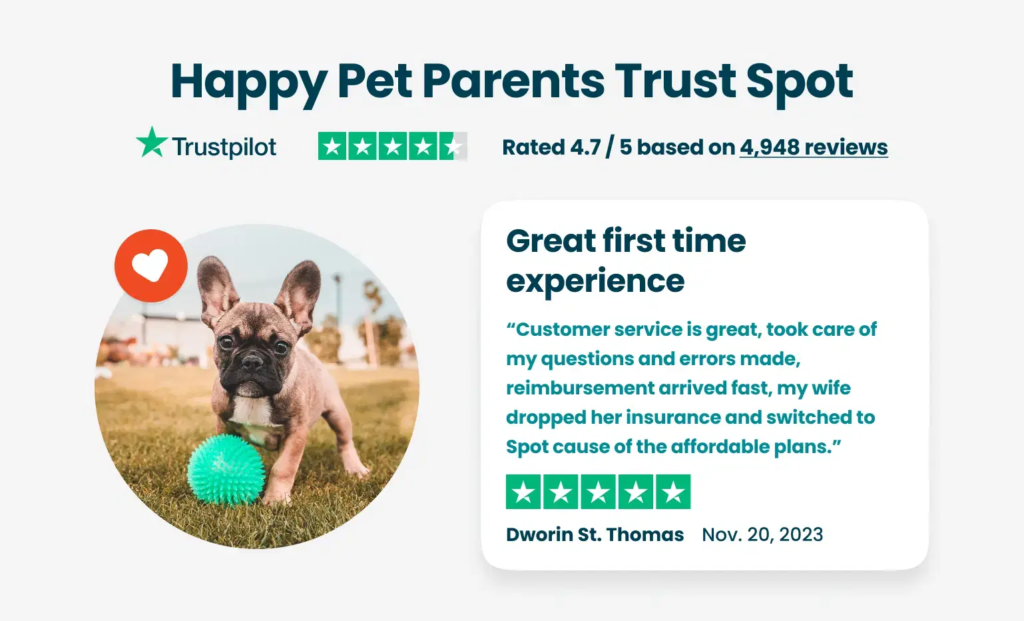

- Spot:

- Rated 4.7/5 on Trustpilot, with positive feedback on affordability and customer service.

- BBB rating is slightly lower due to isolated complaints about claim processing times.

Key Takeaways from Reviews

- Pets Best is ideal for pet owners seeking reliability and faster payouts, particularly for accident and illness plans.

- Spot appeals to budget-conscious owners or those interested in wellness and holistic treatment coverage but may require more patience with claim timelines.

Customization and Flexibility

When comparing Pets Best vs Spot Pet Insurance, one of the most important aspects is how well each provider allows pet owners to customize their plans to fit specific needs. From adjusting coverage limits to adding optional benefits, both providers offer varying degrees of flexibility.

Policy Options

- Pets Best: Offers extensive flexibility, allowing pet owners to select from a range of plans, including accident-only, accident and illness, and wellness add-ons. This range of options caters to pets of all ages and health conditions.

- Spot Pet Insurance: Focuses on simplicity with two main plans: accident-only and accident and illness. While less extensive than Pets Best, Spot’s plans are straightforward and easy to understand.

Customizing Deductibles

- Pets Best: Provides a broad range of deductible options, from $50 to $1,000, allowing owners to lower their premiums or reduce out-of-pocket expenses based on their preferences.

- Spot: Offers deductibles starting at $100 and going up to $1,000, providing a similar level of customization but with fewer tier options compared to Pets Best.

Adjusting Reimbursement Rates

- Both providers allow pet owners to choose reimbursement rates of 70%, 80%, or 90%, enabling them to decide how much they want to recover from eligible expenses.

Coverage Limits

- Pets Best: Offers several annual limit options, including unlimited coverage, which is ideal for pet owners concerned about high veterinary costs.

- Spot: Provides customizable annual limits, typically ranging from $2,500 to unlimited, giving flexibility based on budget and risk tolerance.

Add-On Options

- Pets Best: Offers a routine care wellness add-on that includes coverage for vaccinations, dental cleanings, and regular check-ups.

- Spot: Also provides a preventive care add-on with two tiers of coverage, allowing pet owners to choose the level of wellness care they want.

Specialized Needs

- Pets Best: Stands out by covering prosthetic devices and wheelchairs, making it a great option for pets with mobility issues.

- Spot: Gains points for its coverage of alternative therapies, like acupuncture and behavioral treatments, appealing to owners who prefer holistic options.

Key Differences

- Pets Best provides more granular control over coverage features and limits, making it a better choice for those seeking highly personalized plans.

- Spot’s streamlined offerings are simpler to navigate, making it appealing for first-time pet insurance buyers or those who don’t require extensive customization.

Network and Accessibility

A crucial factor in choosing the right pet insurance is the network and accessibility of services. When comparing Pets Best vs Spot Pet Insurance, both providers offer wide-reaching flexibility for pet owners, but there are notable differences in their approaches to vet compatibility and overall accessibility.

Veterinary Network Compatibility

- Pets Best: Does not require pet owners to use a specific veterinary network. You can visit any licensed veterinarian in the United States, making it highly accessible regardless of location.

- Spot Pet Insurance: Similarly allows pet owners to visit any licensed veterinarian or specialist in the U.S. and Canada. This flexibility is particularly beneficial for pet owners who travel frequently or have unique veterinary needs.

Out-of-Network Coverage

- Both providers ensure coverage for all licensed vets, so there’s no concern about being “out-of-network.” This eliminates the need for pet owners to switch vets or worry about limited options.

International Coverage

- Pets Best: Offers coverage for accidents and illnesses that occur while traveling with your pet outside the United States, provided you visit a licensed veterinarian.

- Spot: Also provides international coverage, though it’s primarily focused on the U.S. and Canada. Ensure you check specific policy details if you travel frequently with your pet.

Accessibility of Customer Support

- Pets Best: Offers multiple channels for support, including phone, email, and live chat. The mobile app and online portal make managing policies and claims simple.

- Spot: Provides robust customer service with similar options, including live chat, phone support, and an easy-to-use website for managing policies and filing claims.

Special Accessibility Features

- Pets Best: Includes a mobile app that allows for claim submissions, viewing policy details, and tracking claim statuses on the go.

- Spot: Offers a streamlined online portal and app with similar functionalities, making it easy for tech-savvy pet owners to manage their insurance.

Key Takeaways

- Both providers excel in network flexibility, allowing visits to any licensed vet without restrictions.

- Pets Best slightly edges out in international accessibility for travelers, but Spot is just as reliable for U.S. and Canadian pet owners.

Wellness and Preventive Care

Wellness and preventive care are essential aspects of pet health, covering routine expenses like vaccinations, dental cleanings, and check-ups. When comparing Pets Best vs Spot Pet Insurance, both providers offer optional wellness plans, but their offerings differ in coverage and flexibility.

What Is Covered

- Pets Best:

- Offers two wellness add-ons: EssentialWellness and BestWellness.

- Covers routine care such as:

- Vaccinations

- Annual exams

- Flea, tick, and heartworm prevention

- Spaying/neutering

- Microchipping

- Dental cleanings

- Higher-tier plans like BestWellness provide more reimbursement for these services.

- Spot Pet Insurance:

- Provides two preventive care options: Gold Plan and Platinum Plan.

- Covers similar routine care, including:

- Vaccinations

- Wellness exams

- Dental cleanings

- Deworming

- Microchipping

- Flea and tick prevention

- The Platinum Plan includes additional benefits like spaying/neutering and a higher annual cap for preventive expenses.

Annual Limits and Reimbursements

- Pets Best: Wellness plans have set reimbursement amounts for each type of preventive care, ensuring transparency but limiting flexibility if specific costs exceed those amounts.

- Spot: Offers higher annual limits with their Platinum Plan, providing more comprehensive coverage for pet owners who anticipate frequent routine care needs.

Customizability

- Pets Best: Wellness plans are optional add-ons, so you can choose whether to include them based on your pet’s needs and budget.

- Spot: Also offers wellness plans as optional add-ons, making it easy to customize policies to include only what’s necessary.

Key Differences

- Pets Best: Offers slightly lower premiums for wellness add-ons but with fixed reimbursement caps for each service.

- Spot: Provides broader reimbursement under its Platinum Plan, making it ideal for pet owners seeking extensive preventive care coverage.

Is Wellness Coverage Worth It?

- For younger pets or those requiring frequent vaccinations and dental cleanings, both providers offer value through their wellness plans.

- For older pets, wellness coverage may not be as cost-effective unless they regularly need routine care.

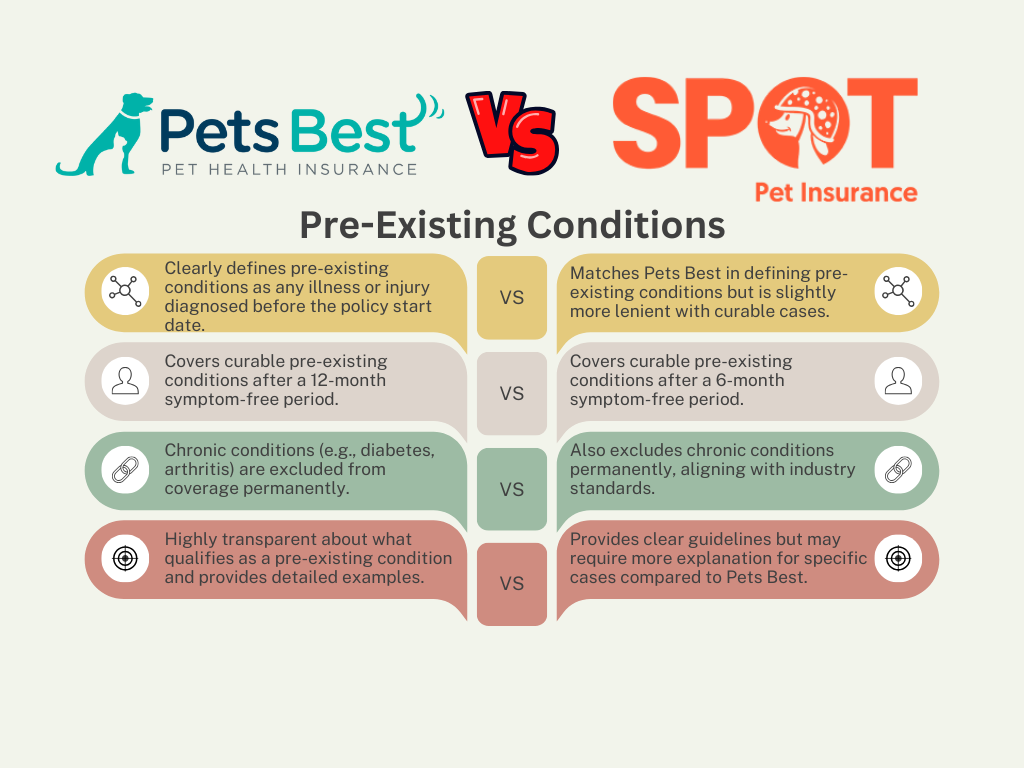

Pre-existing Conditions

Pre-existing conditions are a critical consideration when evaluating Pets Best vs Spot Pet Insurance, as these policies typically exclude coverage for such conditions. However, the way each provider defines and handles pre-existing conditions can influence your decision.

What Are Pre-existing Conditions?

A pre-existing condition refers to any illness, injury, or health issue that your pet has shown symptoms of, been diagnosed with, or received treatment for before the start of your insurance policy. Common examples include:

- Chronic illnesses like diabetes or arthritis

- Past injuries such as broken bones

- Conditions like hip dysplasia or allergies

Pets Best Pre-existing Condition Policy

- Exclusions: Pets Best does not cover pre-existing conditions, but they provide a clear policy on what qualifies as pre-existing.

- Curable Conditions: Pets Best will consider some curable conditions (e.g., ear infections or urinary tract infections) eligible for future coverage if your pet remains symptom-free for 12 months.

- Chronic Conditions: Ongoing or incurable conditions, such as cancer or diabetes, are permanently excluded from coverage.

Spot Pet Insurance Pre-existing Condition Policy

- Exclusions: Spot also excludes pre-existing conditions, but they have a lenient approach to curable conditions.

- Curable Conditions: Spot may cover pre-existing conditions if your pet has been symptom-free and treatment-free for 6 months, a shorter waiting period compared to Pets Best.

- Chronic Conditions: Similar to Pets Best, incurable or ongoing conditions remain excluded.

Key Differences

- Waiting Periods for Curable Conditions: Spot’s 6-month period for curable conditions is shorter than Pets Best’s 12-month requirement, making Spot a better choice for pets with previously resolved issues.

- Policy Transparency: Both providers clearly outline their pre-existing condition policies, but Spot’s leniency for curable conditions may appeal to pet owners seeking flexibility.

Why Pre-existing Conditions Matter

Understanding how each provider handles pre-existing conditions helps you assess whether your pet can still benefit from insurance. While these conditions are excluded, enrolling your pet early (before any health issues arise) ensures broader coverage.

Deductible and Reimbursement Models

When deciding between Pets Best vs Spot Pet Insurance, understanding how deductibles and reimbursement models work is key to finding the most cost-effective policy. Both providers offer flexibility, but the differences in their approaches can impact your overall experience and expenses.

What Are Deductibles?

A deductible is the amount you pay out of pocket for covered veterinary expenses before the insurance policy begins to reimburse you. Both Pets Best and Spot offer adjustable deductible options to help you balance monthly premiums and upfront costs.

Pets Best Deductible Options

- Annual Deductibles: Pets Best uses an annual deductible model, meaning you pay the deductible once per policy year, regardless of how many claims you file.

- Range: Deductible options range from $50 to $1,000, allowing you to customize based on your budget and risk tolerance. Lower deductibles lead to higher monthly premiums, and vice versa.

- Transparency: Pets Best provides clear policy terms to help you understand how your deductible affects coverage.

Spot Pet Insurance Deductible Options

- Annual Deductibles: Like Pets Best, Spot uses an annual deductible structure, simplifying the claims process for pet owners.

- Range: Spot offers deductible options from $100 to $1,000, with similar flexibility to customize your plan. The slightly higher starting deductible may be worth considering if you prefer lower premiums.

Reimbursement Models

Reimbursement is the percentage of your eligible veterinary expenses that the insurance provider pays after your deductible is met.

- Pets Best:

- Offers reimbursement rates of 70%, 80%, or 90%.

- High flexibility ensures you can select a rate that fits your financial needs.

- Reimbursements are processed quickly, particularly with direct deposit.

- Spot:

- Provides the same reimbursement rate options of 70%, 80%, or 90%.

- Spot focuses on keeping its reimbursement process simple and consistent, though some customers report slightly longer processing times.

Key Differences

- Deductible Options: Pets Best starts at a lower $50 deductible, which may be appealing for pet owners who prefer minimal out-of-pocket costs. Spot’s minimum deductible is $100, but this difference is minor in most cases.

- Reimbursement Rates: Both providers offer the same options, making them comparable in this aspect. The choice ultimately depends on how much you’re willing to pay upfront versus how much you want reimbursed.

Choosing the Right Model

- Opt for a lower deductible and higher reimbursement rate if you expect frequent or high-cost vet visits.

- Choose a higher deductible and lower reimbursement rate if you want to save on monthly premiums and only anticipate occasional claims.

Waiting Periods

When comparing Pets Best vs Spot Pet Insurance, understanding waiting periods is essential. A waiting period is the time between the start of your policy and when coverage begins. Both providers implement waiting periods to prevent fraudulent claims, but their timelines differ slightly.

Pets Best Waiting Periods

- Accidents: Coverage for accidents begins after 3 days, which is one of the shortest waiting periods in the industry.

- Illnesses: Coverage for illnesses starts after a 14-day waiting period.

- Special Conditions: For conditions like cruciate ligament injuries or hip dysplasia, Pets Best enforces a 6-month waiting period, though this can be waived if your vet confirms no pre-existing signs during enrollment.

Spot Pet Insurance Waiting Periods

- Accidents: Spot matches Pets Best with a 3-day waiting period for accidents.

- Illnesses: Spot also requires a 14-day waiting period for illnesses, ensuring consistency with industry standards.

- Special Conditions: Spot imposes a 6-month waiting period for orthopedic conditions like cruciate ligament injuries, with no options for early waivers.

Why Waiting Periods Matter

Waiting periods protect insurance providers from covering pre-existing or immediate claims. While the timelines for Pets Best and Spot are similar, the option to waive the 6-month waiting period for Pets Best gives it a slight edge for pet owners looking for faster coverage for orthopedic issues.

Tips to Minimize Waiting Periods

- Enroll your pet as early as possible, especially when they are young and healthy, to avoid conditions being labeled as pre-existing during the waiting period.

- Schedule a wellness exam when signing up for Pets Best to potentially waive the extended waiting period for certain conditions.

Key Differences

- Both providers share identical waiting periods for accidents and illnesses, making them equally competitive in this area.

- Pets Best stands out with its flexibility to waive the waiting period for specific conditions, offering a potential advantage for pet owners with active pets prone to orthopedic issues.

Discounts and Offers

When comparing Pets Best vs Spot Pet Insurance, discounts and promotional offers can significantly affect affordability. Both providers offer ways to save, but their discounts and eligibility criteria differ, making them appealing to different types of pet owners.

Pets Best Discounts

- Multi-Pet Discount: Pets Best offers a 5% discount when you insure multiple pets, making it a great option for households with more than one furry friend.

- Employee Benefits Program: If your employer partners with Pets Best, you may qualify for discounted rates as part of a workplace benefits package.

- Military Discount: Active and retired military personnel may be eligible for special discounts, depending on availability.

- Seasonal Promotions: Occasionally, Pets Best runs promotional offers for new customers, such as waived enrollment fees or first-month discounts.

Spot Pet Insurance Discounts

- Multi-Pet Discount: Spot also provides a 10% discount for insuring multiple pets, offering a greater saving compared to Pets Best for pet owners with more than one animal.

- Seasonal Deals and Promotions: Spot frequently runs promotional campaigns, such as reduced premiums for the first year or bonus perks for signing up during specific periods.

- Referral Programs: Spot sometimes offers referral discounts, rewarding customers who refer friends or family to their service.

Key Differences

- Multi-Pet Savings: Spot offers a higher discount for multiple pets (10%) compared to Pets Best (5%), making it the better choice for households with several pets.

- Unique Discounts: Pets Best caters to military families and employees through its targeted discount programs, while Spot focuses more on promotional campaigns and referrals.

How to Maximize Discounts

- Insure multiple pets to take advantage of the multi-pet discounts from either provider.

- Look out for seasonal promotions or enrollment offers when signing up.

- If eligible, check with your employer or military benefits to see if you qualify for additional savings with Pets Best.

Why Discounts Matter

Even small discounts can lead to significant savings over the life of an insurance policy, especially if you’re insuring multiple pets or opting for comprehensive coverage. Choosing the provider with the best discount structure for your situation can help reduce costs without compromising coverage.

Technology and User Experience

When comparing Pets Best vs Spot Pet Insurance, the ease of managing policies and claims through technology is a significant consideration. Both providers invest in user-friendly platforms, but their apps and online portals offer slightly different experiences. Here’s how they compare.

Pets Best Technology and User Experience

- Mobile App: Pets Best has a highly-rated mobile app available on iOS and Android. The app allows pet owners to:

- Submit claims by uploading photos of invoices.

- Track claim status in real-time.

- Manage policies, including updating payment information or adding pets.

- Access a 24/7 Pet Helpline for health advice from licensed veterinarians.

- Online Portal: The desktop portal provides similar functionality, ensuring accessibility for users who prefer using a computer.

- Ease of Use: Customers frequently praise the app for its intuitive design and smooth navigation.

Spot Pet Insurance Technology and User Experience

- Mobile App: Spot offers an easy-to-use mobile app that allows pet owners to:

- File claims directly through the app by uploading receipts and documents.

- Monitor the status of submitted claims.

- Adjust coverage details or payment methods as needed.

- Online Portal: Spot’s website also provides comprehensive policy management tools, making it convenient for users who prefer web-based access.

- Ease of Use: Spot’s app and portal are designed with simplicity in mind, but some users report that navigation could be more streamlined compared to Pets Best.

Key Differences

- Pets Best: Stands out with its 24/7 Pet Helpline, which provides instant access to licensed veterinarians for health advice, making it an excellent tool for first-time pet owners or those with frequent concerns.

- Spot: Focuses on straightforward functionality, with tools that cover all essential tasks but lack the additional resources like a helpline.

Customer Feedback

- Pets Best: Customers often highlight the app’s reliability and appreciate features like real-time claim tracking and the Pet Helpline.

- Spot: Users appreciate the simplicity of the app but occasionally mention that navigation could be improved for quicker access to key features.

Why Technology Matters

Pet insurance apps and online portals simplify managing your policy, especially when filing claims or updating information. A user-friendly platform can save time and reduce frustration, making it easier to focus on your pet’s well-being.

Financial Stability and Company Reputation

When choosing between Pets Best vs Spot Pet Insurance, the financial stability and reputation of the company are vital factors. A trustworthy provider ensures long-term reliability and the ability to pay claims consistently. Let’s explore how these two providers compare.

Pets Best Financial Stability

- Company Background: Pets Best was founded in 2005 by a veterinarian and is underwritten by American Pet Insurance Company, a well-established insurer with a strong financial track record.

- Financial Ratings: Pets Best benefits from the backing of its underwriter, which is known for its financial strength and ability to meet claim obligations.

- Market Share: As one of the oldest pet insurance providers, Pets Best has a significant presence in the industry, earning trust from thousands of pet owners over the years.

Spot Pet Insurance Financial Stability

- Company Background: Spot Pet Insurance is a newer player in the pet insurance industry but has quickly gained popularity for its customizable plans and competitive pricing. It is underwritten by the United States Fire Insurance Company, a well-established insurer.

- Financial Ratings: Spot’s underwriter, United States Fire Insurance Company, has a solid reputation for financial stability and reliability.

- Market Share: Spot’s market share is growing rapidly, reflecting increasing trust and adoption by pet owners.

Company Reputation

- Pets Best:

- Known for its transparency, customer service, and fast claim processing.

- Frequently earns positive reviews on platforms like Trustpilot and the Better Business Bureau (BBB), with many customers praising its reliability and ease of use.

- Pets Best has a long-standing reputation, which appeals to pet owners looking for proven reliability.

- Spot:

- Gaining recognition for its user-friendly policies and commitment to offering holistic coverage options like alternative therapies.

- While newer than Pets Best, Spot has received positive feedback for its customer service and affordability.

- Spot’s reputation continues to grow as it establishes itself as a competitive option in the pet insurance market.

Key Differences

- Pets Best: Boasts a longer track record and greater market presence, making it a safer choice for pet owners who prioritize established providers.

- Spot: As a newer provider, Spot offers innovative options and competitive pricing, appealing to pet owners seeking modern solutions.

Why Financial Stability Matters

A financially stable insurer ensures timely claim payments and continued policy support. Pet owners should prioritize companies with strong underwriters and positive reputations to avoid issues during emergencies.

Unique Features and Differentiators

When comparing Pets Best vs Spot Pet Insurance, the unique features and standout benefits of each provider can help pet owners decide which is the best fit for their needs. Both providers offer competitive options, but they also bring unique strengths to the table.

Pets Best Unique Features

- 24/7 Pet Helpline: Pets Best offers a 24/7 Pet Helpline, giving policyholders access to licensed veterinarians for advice on their pet’s health. This feature is ideal for pet owners seeking immediate guidance.

- Prosthetics and Mobility Coverage: Pets Best covers prosthetic devices and wheelchairs, a rare benefit in pet insurance, making it a great option for pets with mobility challenges.

- Lower Deductible Options: With deductibles starting at $50, Pets Best offers more flexibility for pet owners who want to minimize out-of-pocket costs.

- Customizable Wellness Plans: Their two-tier wellness add-ons (EssentialWellness and BestWellness) let pet owners choose coverage that aligns with their routine care needs.

- Fast Claims Processing: Pets Best is well-known for its quick turnaround times, especially when using direct deposit for reimbursements.

Spot Pet Insurance Unique Features

- Holistic Coverage Options: Spot stands out for its coverage of alternative therapies, including acupuncture and chiropractic care, appealing to pet owners who prioritize holistic treatment methods.

- Simplified Plan Structure: Spot’s straightforward accident-only and accident & illness plans make it easier for first-time pet insurance buyers to understand their coverage.

- Generous Multi-Pet Discount: Spot offers a 10% multi-pet discount, which is higher than Pets Best’s 5%, making it a better choice for households with multiple pets.

- Shorter Waiting Period for Curable Pre-existing Conditions: Spot’s 6-month waiting period for curable pre-existing conditions is shorter than Pets Best’s 12-month requirement, providing quicker access to coverage.

- Referral Program: Spot occasionally offers referral bonuses, rewarding policyholders for recommending the service to friends and family.

Key Differences

- Pets Best: Offers features like prosthetic coverage, lower deductible options, and a 24/7 Pet Helpline, making it ideal for owners of pets with specialized needs or those seeking comprehensive customer support.

- Spot: Focuses on holistic care, higher multi-pet discounts, and simplified plans, appealing to pet owners looking for affordability and alternative treatment options.

Why Unique Features Matter

These differentiators provide added value beyond standard pet insurance coverage, helping pet owners select a provider that aligns with their specific preferences and their pet’s needs.

Final Verdict and Recommendation

Choosing between Pets Best vs Spot Pet Insurance ultimately depends on your pet’s specific needs, your budget, and your preferences for coverage features. Both providers offer strong options, but they cater to slightly different audiences. Here’s the final breakdown to help you decide.

When to Choose Pets Best

Pets Best is an excellent choice if you:

- Want quick claims processing with reliable reimbursements.

- Prefer comprehensive coverage options, including prosthetics and mobility aids.

- Appreciate the added value of a 24/7 Pet Helpline for immediate health advice.

- Are looking for customizable deductibles and wellness plans to fit your budget.

- Need coverage for pets with specialized health needs or conditions requiring advanced care.

When to Choose Spot Pet Insurance

Spot is a great option if you:

- Value coverage for holistic treatments like acupuncture and chiropractic care.

- Have multiple pets and want to maximize savings with a 10% multi-pet discount.

- Need straightforward plan options that are easy to understand and manage.

- Want shorter waiting periods for curable pre-existing conditions.

- Prefer an affordable plan for younger pets or those with fewer routine care needs.

Who Wins?

- For Budget-Conscious Pet Owners: Spot is more affordable for multi-pet households and offers a competitive edge with its higher multi-pet discount.

- For Comprehensive Coverage Seekers: Pets Best stands out with its extensive coverage, lower deductible options, and additional benefits like the Pet Helpline.

Final Recommendation

- If you’re looking for robust, flexible coverage with unique perks like mobility aid coverage and faster claims processing, Pets Best is the better option.

- If affordability, holistic care, and simplicity are your priorities, Spot Pet Insurance might be the right choice.

Call-to-Action

Take the time to evaluate your pet’s age, health, and lifestyle to determine which provider aligns best with your needs. Compare quotes from both Pets Best and Spot Pet Insurance to ensure you get the coverage that fits your budget and expectations.

Conclusion

Deciding between Pets Best vs Spot Pet Insurance requires careful consideration of your pet’s needs, your budget, and the features most important to you. Both providers offer strong options, but they shine in different areas.

- Pets Best is ideal for pet owners looking for comprehensive coverage, fast claims processing, and unique benefits like mobility aid coverage and a 24/7 Pet Helpline. It’s a great choice for those who prioritize extensive policy options and flexibility.

- Spot Pet Insurance, on the other hand, is perfect for budget-conscious pet owners or those interested in holistic treatments like acupuncture and chiropractic care. Its straightforward plans and generous multi-pet discounts make it a strong contender for households with multiple pets or simpler coverage needs.

Ultimately, the best choice depends on your individual circumstances. Compare quotes, review policy details, and consider your pet’s health history to ensure you choose the insurance that offers the best protection for your furry friend.

Final Thought

Pet insurance is an investment in your pet’s health and well-being. Whether you choose Pets Best or Spot, the peace of mind that comes with knowing your pet is protected is invaluable.

FAQs

Here are some frequently asked questions to help clarify common concerns about Pets Best vs Spot Pet Insurance. These answers will guide you in making an informed choice for your pet’s insurance needs.

1. Is Pets Best more affordable than Spot Pet Insurance?

It depends on the plan and your pet’s specifics, such as age, breed, and location.

- Pets Best tends to have slightly higher premiums for older pets or comprehensive plans but offers lower deductibles starting at $50.

- Spot is often more affordable for younger pets and provides a 10% multi-pet discount, which is higher than Pets Best’s 5%.

2. Which insurance provider is better for older pets?

- Pets Best may be better for older pets because of its wide range of deductible options and the ability to customize coverage to offset higher premiums.

- Spot also covers older pets but might have higher premiums without as many flexible deductible choices.

3. How do Pets Best and Spot handle pre-existing conditions?

- Both providers exclude pre-existing conditions, but they differ slightly in handling curable conditions.

- Pets Best: Requires a 12-month symptom-free period before covering curable pre-existing conditions.

- Spot: Requires a shorter 6-month symptom-free period, making it more flexible for pets with previously resolved health issues.

4. Can I switch from Pets Best to Spot or vice versa?

Yes, you can switch providers, but keep in mind:

- Any conditions diagnosed or treated while insured with one provider will likely be considered pre-existing and excluded by the new provider.

- Evaluate your current coverage and potential gaps before switching.

5. Do both providers cover exotic pets?

No, both Pets Best and Spot focus on insuring cats and dogs. If you have an exotic pet, you may need to explore specialized insurance providers.

6. Which provider has a better app for managing claims?

- Pets Best has a slightly more feature-rich app, offering real-time claim tracking and a 24/7 Pet Helpline.

- Spot’s app is simple and effective but doesn’t include additional resources like a helpline.

7. Do either Pets Best or Spot offer unlimited coverage?

Yes, both providers offer unlimited annual coverage as an option, ensuring there are no caps on reimbursements for eligible expenses. However, choosing unlimited coverage will increase your premium.

8. Are wellness plans included in standard policies?

No, wellness plans are optional add-ons for both providers.

- Pets Best: Offers two tiers of wellness plans with fixed reimbursements for routine care.

- Spot: Also provides two tiers of preventive care coverage, with higher limits available in its Platinum Plan.

9. How long does it take to get reimbursed?

- Pets Best: Typically processes claims within 5–7 business days.

- Spot: Usually takes 10–14 business days, though this may vary depending on the complexity of the claim.

10. Which provider is better for holistic care?

Spot Pet Insurance is the better choice if you want coverage for alternative therapies like acupuncture and chiropractic care, as these are not covered by Pets Best.