Choosing the right pet insurance can be a daunting task, especially when deciding between top providers like Spot Pet Insurance vs AKC Pet Insurance. Both companies offer robust coverage options designed to protect your pet’s health and ease the financial burden of veterinary care. However, they differ in terms of coverage flexibility, special features, and additional perks, making it essential to understand what each provider brings to the table.

In this comprehensive comparison, we’ll evaluate Spot Pet Insurance vs AKC across key categories like coverage options, pricing, customer reviews, and special features. Whether you’re a new pet owner or an experienced breeder, this guide will help you determine which provider best suits your pet’s needs and your budget.

Keep reading to find out how these two pet insurance companies stack up and discover the pros and cons of each.

Table of Contents

Coverage Options

When comparing Spot Pet Insurance vs AKC Pet Insurance, one of the most important factors to consider is the coverage options each provider offers. Both companies aim to cover a wide range of pet health needs, but they differ in the specifics of their plans. Here’s a breakdown to help you understand how they stack up.

Spot Pet Insurance Coverage Options

Spot offers highly customizable plans designed to suit different budgets and coverage needs. Their key options include:

- Accident-Only Plan: Covers injuries caused by accidents, such as broken bones, swallowed objects, and other emergencies.

- Accident and Illness Plan: Includes everything in the accident-only plan, plus coverage for illnesses like cancer, digestive issues, and infections.

- Optional Wellness Plan: Available as an add-on, this plan covers routine care, such as vaccinations, dental cleanings, and wellness exams.

Spot is especially popular for its flexibility in choosing annual limits, deductibles, and reimbursement rates. This makes it a good choice for pet owners looking for personalized coverage.

AKC Pet Insurance Coverage Options

AKC Pet Insurance offers several coverage tiers, making it ideal for pet owners who want a range of choices. Their plans include:

- Accident-Only Plan: Similar to Spot, this plan covers injuries resulting from accidents.

- Comprehensive Plan: Covers both accidents and illnesses, along with hereditary and congenital conditions.

- Specialized Add-Ons: AKC offers add-ons for breeding coverage, exam fees, and wellness care, which can be purchased separately to enhance the plan.

- Customizable Coverage: AKC allows you to adjust your policy by selecting add-ons that suit your needs, such as dental coverage or behavioral therapies.

Key Differences Between Spot and AKC Coverage

- Routine Care Coverage: Spot’s optional wellness plan includes a broader range of preventive care compared to AKC’s wellness add-ons.

- Breeding Coverage: AKC stands out for offering specialized coverage for breeders, which Spot does not provide.

- Hereditary Conditions: Both providers cover hereditary conditions under comprehensive plans, but Spot tends to highlight this coverage more prominently in their standard offerings.

By carefully comparing the coverage options provided by Spot Pet Insurance vs AKC, pet owners can select a plan that best fits their pet’s health needs and their own budget.

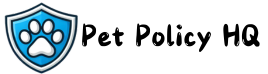

Exclusions

Understanding exclusions is critical when deciding between Spot Pet Insurance vs AKC Pet Insurance, as these determine what will not be covered by your policy. Both providers have common exclusions typical of pet insurance, but there are subtle differences that might impact your decision.

Spot Pet Insurance Exclusions

Spot Pet Insurance excludes the following:

- Pre-Existing Conditions: Any condition your pet had before coverage began or during the waiting period is not covered. However, Spot does offer coverage for curable conditions if the pet has been symptom-free for 180 days.

- Elective Procedures: Includes non-essential treatments like cosmetic surgeries, ear cropping, or declawing.

- Preventable Illnesses: Illnesses that occur due to lack of preventive care (e.g., parasites if no flea/tick prevention is used).

- Breeding-Related Costs: Spot does not cover costs related to breeding, pregnancy, or whelping.

- Routine Care (Without Add-On): Wellness exams, vaccinations, and dental cleanings are only covered if you purchase the optional wellness plan.

AKC Pet Insurance Exclusions

AKC Pet Insurance has similar exclusions, with a few additional specificities:

- Pre-Existing Conditions: These are not covered, and AKC does not offer any exceptions for curable conditions.

- Elective and Cosmetic Procedures: Includes tail docking, ear cropping, and other non-medical surgeries.

- Preventable Illnesses: Illnesses due to lack of vaccinations or preventive care are excluded.

- Breeding-Related Costs: While AKC provides optional breeding coverage, standard plans do not include these costs.

- Routine Care (Without Add-On): Like Spot, wellness and preventive care are only covered if you purchase the add-on plan.

Key Differences in Exclusions

- Curable Pre-Existing Conditions: Spot may cover curable conditions after a waiting period, while AKC does not.

- Breeding Coverage: AKC offers breeding-related coverage as an add-on, whereas Spot does not provide any options for breeding costs.

- Elective Procedures: Both providers exclude elective procedures, but Spot emphasizes exclusions for non-preventable illnesses more heavily.

Knowing these exclusions helps pet owners avoid unexpected costs by choosing a plan that aligns with their pet’s health needs and lifestyle. When evaluating Spot Pet Insurance vs AKC, it’s essential to review policy details and ask questions about specific exclusions to ensure full understanding.

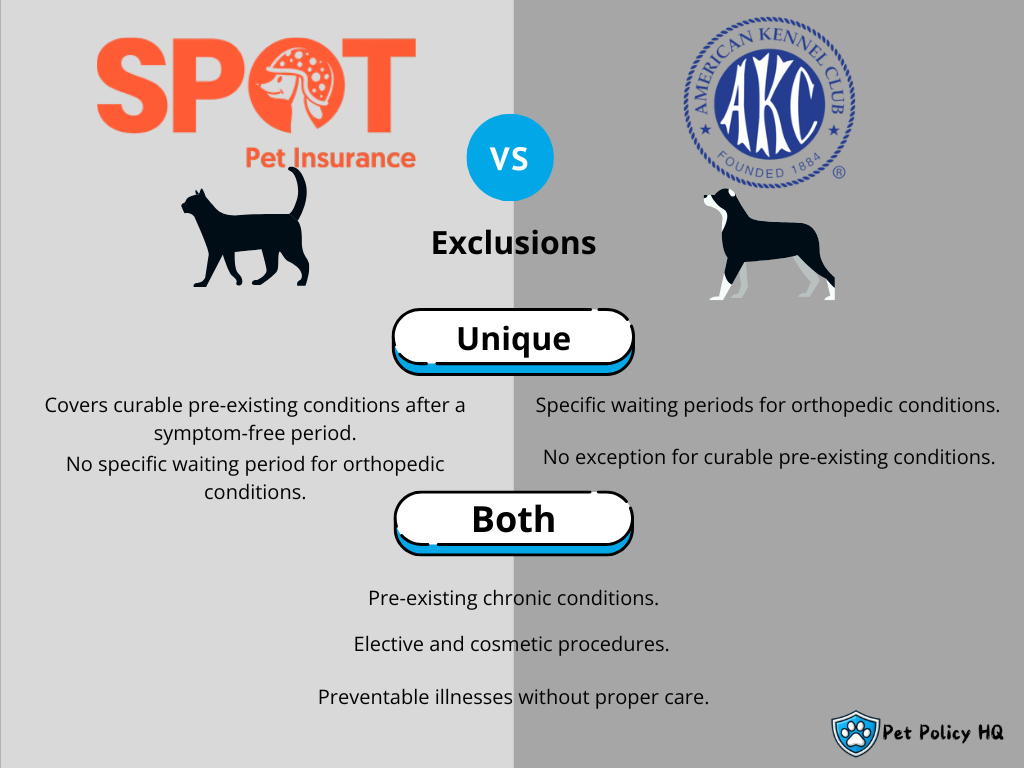

Customization and Flexibility

When comparing Spot Pet Insurance vs AKC Pet Insurance, customization and flexibility play a significant role in determining which provider is better suited for your pet and budget. Both companies offer ways to tailor their plans, but they differ in the range of choices available and how easily you can adapt their policies to your needs.

Spot Pet Insurance: Customization and Flexibility

Spot stands out for its highly customizable plans, allowing pet owners to adjust several key features:

- Annual Limits: Choose from a range of annual coverage limits, starting as low as $2,500 and going up to unlimited.

- Deductibles: Options range from $100 to $1,000, giving you control over how much you pay out-of-pocket before coverage kicks in.

- Reimbursement Rates: Spot offers flexible reimbursement options, including 70%, 80%, or 90%, so you can choose what works best for your budget.

- Optional Wellness Plan: Add wellness coverage for preventive care, such as vaccinations and dental cleanings, to further personalize your policy.

Spot’s flexible approach makes it an excellent option for pet owners who want full control over their coverage and costs.

AKC Pet Insurance: Customization and Flexibility

AKC Pet Insurance also allows for some degree of customization, though its options are slightly more limited compared to Spot:

- Annual Limits: Offers customizable annual limits, but the maximum limit is typically lower than Spot’s unlimited option.

- Deductibles: Provides a range of deductible options, though the minimum deductible tends to start higher than Spot’s $100 option.

- Reimbursement Rates: AKC offers reimbursement rates similar to Spot (70%, 80%, or 90%).

- Specialized Add-Ons: AKC allows you to customize your plan by adding coverage for breeding, exam fees, and wellness care.

While AKC provides decent flexibility, the lack of an unlimited annual limit and fewer base plan options might be a drawback for some pet owners.

Key Differences in Customization and Flexibility

- Annual Limits: Spot offers unlimited coverage, making it more suitable for pet owners who want maximum protection. AKC’s limits may not cover extensive medical costs in extreme cases.

- Deductibles: Spot’s lower deductible options give you more control over out-of-pocket expenses.

- Wellness Coverage: Spot integrates wellness care into its plans as an add-on, whereas AKC requires additional customization through multiple separate add-ons.

Overall, if flexibility and customization are your priorities, Spot Pet Insurance provides a wider range of options to meet your unique needs. AKC Pet Insurance, while customizable, may require additional add-ons for comprehensive coverage.

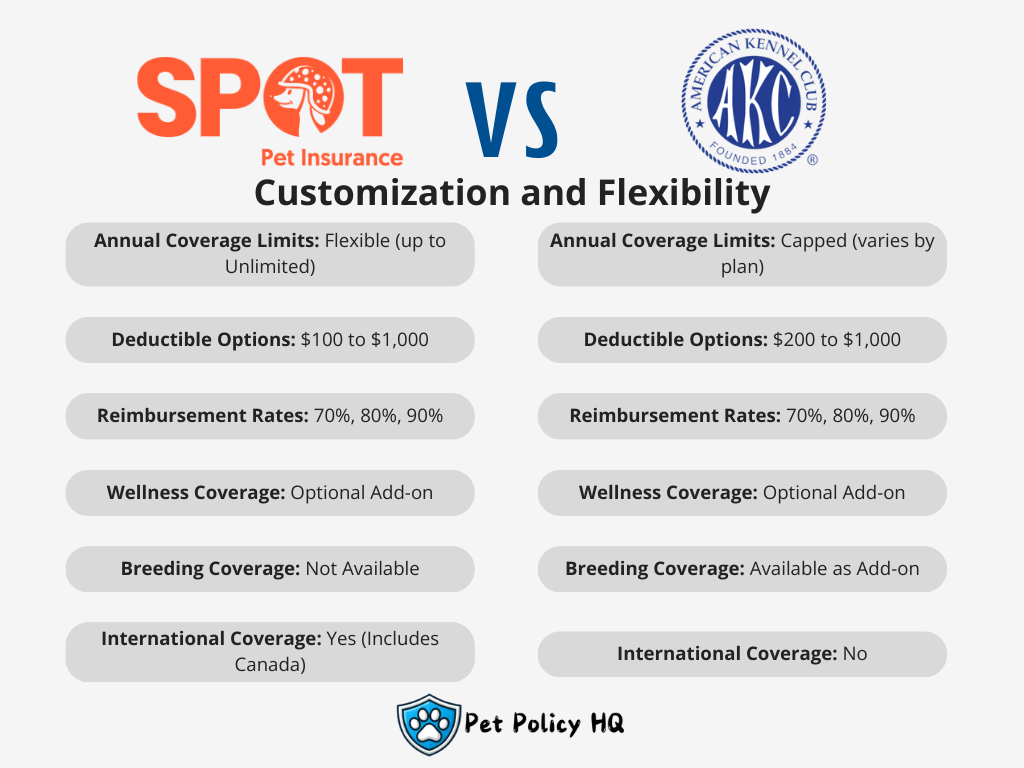

Pricing and Affordability

Cost is a major factor when choosing between Spot Pet Insurance vs AKC Pet Insurance. While both providers aim to offer competitive pricing, the structure of their premiums and the value they deliver can vary significantly. Let’s break down the pricing and affordability of each provider to help you make an informed decision.

Spot Pet Insurance Pricing and Affordability

Spot Pet Insurance is known for its budget-friendly plans and customizable options, making it a flexible choice for pet owners. Here are some key points about Spot’s pricing:

- Base Premiums: Spot’s plans start at around $10/month for accident-only coverage, with comprehensive plans costing more based on the level of coverage selected.

- Customization Options: Adjusting annual limits, deductibles, and reimbursement rates allows you to control your premium costs. For example, higher deductibles and lower reimbursement rates can significantly reduce monthly premiums.

- Wellness Plan Add-On: Spot offers an optional wellness plan for routine care, starting at $9.95/month, which is a cost-effective way to include preventive care.

- Discounts: Spot occasionally offers multi-pet discounts, helping owners with more than one pet save on premiums.

Spot’s pricing model is ideal for pet owners who want to tailor their policy to fit both their pet’s needs and their budget.

AKC Pet Insurance Pricing and Affordability

AKC Pet Insurance offers competitive pricing, but its affordability can depend on the specific coverage and add-ons selected. Key details include:

- Base Premiums: AKC’s accident-only plans typically start at around $15/month, with comprehensive plans ranging higher based on the coverage limits and add-ons chosen.

- Add-Ons: Unlike Spot’s bundled wellness plan, AKC offers several add-ons, such as coverage for exam fees or breeding costs, which can increase monthly premiums.

- Customization Options: AKC allows some flexibility in adjusting deductibles and reimbursement rates, but its options for lowering costs are slightly more limited than Spot’s.

- Discounts: AKC also provides multi-pet discounts and occasionally offers promotional pricing, which can help reduce overall costs.

AKC’s pricing structure works well for pet owners who need specialized add-ons or are looking for breeder-specific coverage.

Key Differences in Pricing

- Base Costs: Spot’s accident-only plans tend to be slightly more affordable than AKC’s.

- Add-On Costs: Spot’s wellness plan is a single add-on option, whereas AKC offers multiple separate add-ons that can make premiums higher.

- Customizability: Spot provides more ways to lower premiums through flexible deductibles, reimbursement rates, and unlimited annual limit options.

When comparing Spot Pet Insurance vs AKC, Spot is generally more affordable for pet owners seeking basic or mid-level coverage, while AKC might be more suitable for those requiring niche add-ons, albeit at a higher cost.

Claims Process

When evaluating Spot Pet Insurance vs AKC Pet Insurance, understanding the claims process is essential. A straightforward and efficient claims process can save time and reduce stress when dealing with unexpected pet medical expenses. Here’s a detailed comparison of how both providers handle claims.

Spot Pet Insurance Claims Process

Spot is known for its user-friendly and transparent claims process. Key features include:

- Submission Options: Claims can be submitted online through Spot’s website or mobile app. The digital interface is intuitive and guides you through the required steps.

- Required Documentation: Pet owners need to upload an itemized invoice and proof of payment for the services provided by the veterinarian.

- Reimbursement Timeframe: Spot typically processes claims within 10-14 business days, which is standard in the industry.

- Direct Deposits: Spot offers the option to receive reimbursements via direct deposit, making it quick and hassle-free for pet owners.

- Claim Tracking: You can track your claim status in real-time through the mobile app, which provides updates at each stage of the review process.

Spot’s streamlined approach makes it a convenient option for busy pet owners who want a seamless claims experience.

AKC Pet Insurance Claims Process

AKC Pet Insurance also offers a relatively straightforward claims process, but there are some differences to note:

- Submission Options: Claims can be submitted online via the AKC Pet Insurance portal or mailed in. However, there is no dedicated mobile app, which might be less convenient for some users.

- Required Documentation: Similar to Spot, AKC requires an itemized invoice and proof of payment from your veterinarian.

- Reimbursement Timeframe: Claims are generally processed within 14-21 business days, which is slightly longer than Spot’s average timeframe.

- Payment Options: AKC provides reimbursements via mailed checks or direct deposit, depending on your preference.

- Claim Tracking: While you can check the status of your claim online, updates are not as detailed or frequent compared to Spot’s system.

While AKC’s claims process is efficient, the lack of a dedicated mobile app and slightly longer processing times may be a drawback for pet owners seeking faster reimbursement.

Key Differences in Claims Process

- Submission Convenience: Spot’s mobile app offers more convenience for on-the-go submissions, while AKC primarily relies on a web portal.

- Reimbursement Timeframe: Spot typically processes claims faster than AKC, making it a better option for pet owners who need quicker payouts.

- Claim Tracking: Spot provides more detailed updates through its mobile app, while AKC’s tracking system is more basic.

When comparing Spot Pet Insurance vs AKC, Spot provides a more modern and streamlined claims process, whereas AKC offers reliable but slightly slower service.

Reimbursement Models

The reimbursement model is a crucial factor when comparing Spot Pet Insurance vs AKC Pet Insurance, as it determines how much you’ll be reimbursed for covered expenses. Both providers offer flexible reimbursement options, but there are differences in how they structure their models.

Spot Pet Insurance Reimbursement Models

Spot provides pet owners with significant flexibility in choosing their reimbursement rate, which allows for better control over monthly premiums and out-of-pocket costs. Key features include:

- Reimbursement Rate Options: Spot offers three options: 70%, 80%, and 90%. You can select the rate that best aligns with your budget and coverage preferences.

- Customizable Plans: Lower reimbursement rates result in lower premiums, which is ideal for pet owners looking to save on monthly costs. Higher reimbursement rates ensure more coverage when claims are approved.

- Payout Methods: Spot reimburses claims via direct deposit or mailed checks, providing convenience for pet owners.

- No Cap on Per-Incident Payouts: Spot does not impose limits on the reimbursement amount per incident, as long as it stays within the annual coverage limit.

Spot’s reimbursement model is designed to be adaptable, making it a top choice for pet owners who value flexibility and transparency.

AKC Pet Insurance Reimbursement Models

AKC Pet Insurance also offers multiple reimbursement options, but its structure is slightly less flexible compared to Spot. Key features include:

- Reimbursement Rate Options: AKC provides the same percentage choices (70%, 80%, and 90%) as Spot.

- Customizable Plans: Like Spot, AKC allows you to adjust reimbursement rates to influence your premium costs. However, the lack of unlimited annual coverage in most plans may limit reimbursement potential for extensive medical bills.

- Payout Methods: AKC also offers direct deposit and check reimbursement options, giving pet owners flexibility in how they receive payments.

- Per-Incident and Annual Limits: AKC may impose per-incident caps on reimbursements depending on the chosen plan, which could restrict coverage for high-cost treatments.

AKC’s reimbursement model works well for standard coverage needs but may not be as beneficial for pet owners facing high medical expenses.

Key Differences in Reimbursement Models

- Annual Coverage Limits: Spot offers unlimited annual coverage options, whereas AKC typically has capped annual limits.

- Per-Incident Caps: Spot does not have per-incident caps, while AKC may impose them depending on the plan.

- Flexibility: Both providers allow customization, but Spot’s options are more robust due to its unlimited annual limit feature.

When comparing Spot Pet Insurance vs AKC, Spot’s reimbursement model provides more flexibility and higher potential payouts, making it a better choice for pet owners seeking comprehensive financial protection.

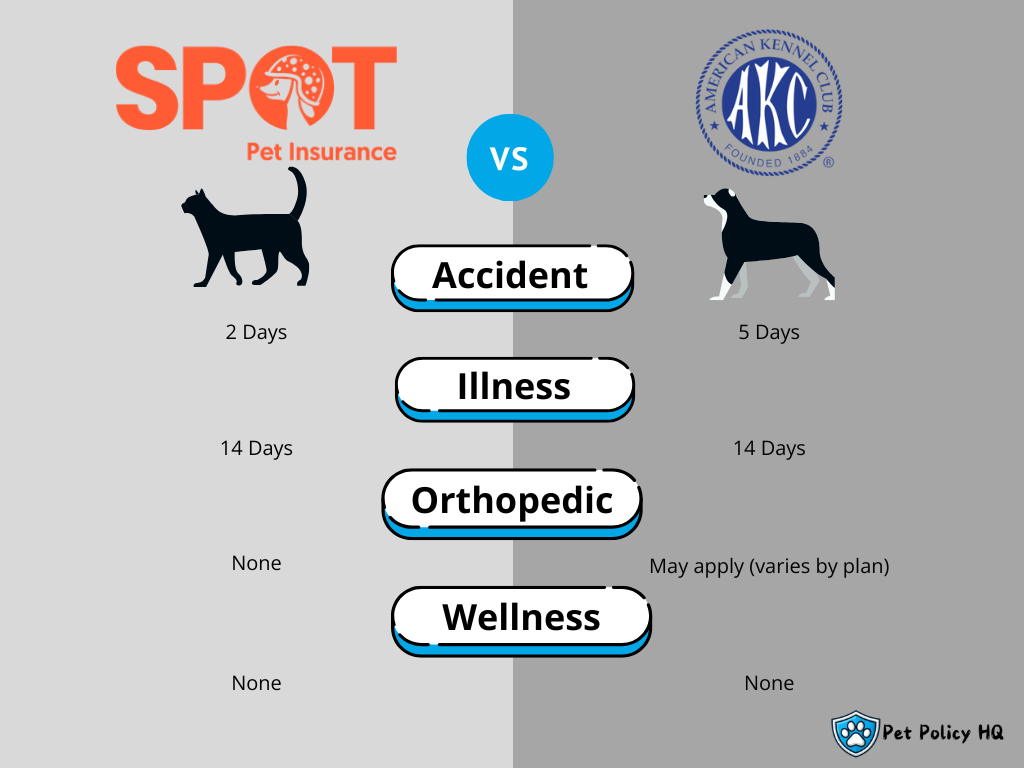

Waiting Periods

Waiting periods are an important consideration when comparing Spot Pet Insurance vs AKC Pet Insurance, as they determine how soon coverage begins after enrolling. Both providers have standard waiting periods for accidents, illnesses, and other conditions, but there are differences worth noting.

Spot Pet Insurance Waiting Periods

Spot Pet Insurance has relatively standard waiting periods, ensuring coverage begins promptly while also protecting against fraudulent claims. The details are as follows:

- Accident Coverage: Begins after a 2-day waiting period, which is one of the shortest in the industry.

- Illness Coverage: Has a 14-day waiting period before coverage takes effect.

- Orthopedic Conditions: Spot does not have a specific waiting period for orthopedic issues beyond the general illness waiting period.

- Optional Wellness Coverage: Wellness plans do not have waiting periods, so coverage for preventive care begins immediately upon enrollment.

Spot’s short 2-day waiting period for accidents gives it an edge for pet owners seeking quick coverage for emergencies.

AKC Pet Insurance Waiting Periods

AKC Pet Insurance also has standard waiting periods for accidents and illnesses, but they are slightly longer compared to Spot. Key details include:

- Accident Coverage: Begins after a 5-day waiting period.

- Illness Coverage: Comes into effect after a 14-day waiting period, similar to Spot.

- Orthopedic Conditions: Some plans may include specific waiting periods for orthopedic issues, which can vary depending on the policy and your pet’s age or breed.

- Add-On Coverage: Wellness plans or specialized add-ons like breeding coverage may have no waiting periods or minimal delays.

AKC’s waiting periods are in line with industry standards but slightly longer than Spot’s for accident coverage.

Key Differences in Waiting Periods

- Accident Coverage: Spot offers a shorter 2-day waiting period for accidents compared to AKC’s 5-day period.

- Illness Coverage: Both providers have the same 14-day waiting period for illnesses.

- Orthopedic Conditions: Spot does not impose additional waiting periods for orthopedic conditions, whereas AKC may include specific waiting periods depending on the plan.

When comparing Spot Pet Insurance vs AKC, Spot’s shorter waiting period for accident coverage and lack of extra delays for orthopedic conditions make it the more attractive option for pet owners who want quicker access to coverage.

Coverage for Pre-Existing Conditions

When comparing Spot Pet Insurance vs AKC Pet Insurance, it’s essential to understand how each provider handles pre-existing conditions. While most pet insurance companies do not cover pre-existing conditions, there are nuances in how they define and address these conditions that can make a significant difference for pet owners.

Spot Pet Insurance Coverage for Pre-Existing Conditions

Spot Pet Insurance has a more flexible approach to pre-existing conditions compared to many competitors. Here are the key details:

- Definition of Pre-Existing Conditions: Spot considers a pre-existing condition as any illness, injury, or symptom that occurred before coverage began or during the waiting period.

- Curable Conditions: Spot makes an exception for certain curable conditions. If your pet has been symptom-free and treatment-free for 180 days, the condition may no longer be considered pre-existing and could be covered in the future. Examples include respiratory infections or ear infections.

- Chronic Conditions: Chronic conditions like diabetes or arthritis, which are ongoing or cannot be cured, remain excluded.

Spot’s willingness to cover curable pre-existing conditions after a waiting period gives it an edge for pet owners whose pets have experienced minor health issues in the past.

AKC Pet Insurance Coverage for Pre-Existing Conditions

AKC Pet Insurance has a more traditional policy regarding pre-existing conditions. The details include:

- Definition of Pre-Existing Conditions: AKC defines pre-existing conditions as any illness, injury, or symptom present before the policy start date or during the waiting period.

- Curable Conditions: Unlike Spot, AKC does not explicitly state that curable conditions can be covered after a symptom-free period. Once a condition is classified as pre-existing, it remains excluded.

- Chronic Conditions: Similar to Spot, chronic or incurable conditions are not covered.

While AKC Pet Insurance provides reliable standard coverage, its lack of flexibility for curable pre-existing conditions may be a drawback for some pet owners.

Key Differences in Coverage for Pre-Existing Conditions

- Curable Conditions: Spot covers curable conditions after a 180-day symptom-free period, whereas AKC does not.

- Chronic Conditions: Neither provider covers chronic or incurable pre-existing conditions, which is standard across the industry.

- Policy Flexibility: Spot’s approach to curable conditions makes it more appealing for pets with minor, treatable health histories.

When comparing Spot Pet Insurance vs AKC, Spot stands out for its more lenient and flexible policy on curable pre-existing conditions, making it a better choice for pets with a manageable health history.

Wellness and Preventive Care Options

When comparing Spot Pet Insurance vs AKC Pet Insurance, the availability of wellness and preventive care options is an important factor to consider. These plans help cover routine expenses like vaccinations, annual check-ups, and dental cleanings, ensuring your pet stays healthy while reducing out-of-pocket costs.

Spot Pet Insurance Wellness and Preventive Care Options

Spot offers an optional Preventive Care Plan, which is available as an add-on to its regular insurance policies. Key features of this plan include:

- No Deductible or Waiting Periods: Wellness coverage begins immediately and does not require you to meet a deductible.

- Two Plan Options:

- Gold Plan: Covers up to $250 annually for preventive care, including vaccinations, wellness exams, dental cleanings, and more.

- Platinum Plan: Covers up to $450 annually with additional allowances for services like spaying/neutering and more comprehensive dental work.

- Customizable: This add-on allows pet owners to prioritize routine care without affecting their accident and illness coverage.

Spot’s wellness options are straightforward, offering excellent value for pet owners who want to bundle preventive care with their primary coverage.

AKC Pet Insurance Wellness and Preventive Care Options

AKC also offers Wellness Care Add-Ons, designed to cover routine and preventive expenses. Here’s what you need to know:

- Customizable Add-Ons: AKC allows you to choose specific wellness packages, which can be added to any core insurance plan.

- Wellness Package Options:

- Basic Wellness: Covers essential services like vaccinations and routine exams.

- Premier Wellness: Includes more comprehensive coverage, such as spaying/neutering and microchipping.

- Annual Limits: Each package has fixed annual reimbursement limits for various services, so you’ll want to review the coverage caps carefully.

AKC’s wellness options provide flexibility but may require closer attention to ensure the chosen package aligns with your pet’s needs.

Key Differences in Wellness and Preventive Care Options

- No Waiting Periods: Both Spot and AKC begin wellness coverage immediately, but Spot emphasizes simplicity with fewer packages to choose from.

- Plan Options: Spot offers two comprehensive preventive care plans, while AKC provides more granular customization through multiple add-on packages.

- Annual Limits: Spot’s limits are bundled by plan, whereas AKC specifies limits for individual services, which may require more detailed tracking.

When comparing Spot Pet Insurance vs AKC, Spot’s wellness plans are simpler and offer broader coverage, while AKC provides more customization but with stricter annual caps for individual services.

Network Flexibility

When deciding between Spot Pet Insurance vs AKC Pet Insurance, network flexibility is a key factor to consider. A flexible network allows you to choose your preferred veterinarian or specialist without restrictions, ensuring your pet gets the best care possible.

Spot Pet Insurance Network Flexibility

Spot Pet Insurance provides excellent network flexibility, making it a popular choice for pet owners who want freedom in choosing veterinary care. Key features include:

- Any Licensed Veterinarian: Spot allows you to visit any licensed veterinarian or specialist in the United States, including emergency and specialty clinics.

- No Network Restrictions: There are no in-network or out-of-network requirements, so you don’t need to worry about whether a provider is covered.

- International Coverage: Spot extends its flexibility by covering treatments from licensed veterinarians in Canada, making it a great choice for frequent travelers.

Spot’s network flexibility ensures you can take your pet to the vet you trust most, whether it’s a local clinic or a specialist.

AKC Pet Insurance Network Flexibility

AKC Pet Insurance also offers strong network flexibility, similar to Spot, but with a few differences in additional coverage:

- Any Licensed Veterinarian: AKC allows you to visit any licensed veterinarian in the United States, ensuring broad access to care.

- No Network Restrictions: Like Spot, AKC does not restrict you to a specific network of providers.

- Specialized Breeder Coverage: For pet owners who are breeders, AKC’s specialized add-ons may align better with specific breeder-focused veterinary care.

While AKC’s network flexibility is comparable to Spot’s, it does not include international coverage, which could be a limitation for pet owners who travel frequently.

Key Differences in Network Flexibility

- International Coverage: Spot covers treatments in Canada, giving it an edge for pet owners who travel internationally. AKC’s coverage is limited to the United States.

- Specialized Breeder Options: AKC offers breeder-specific add-ons, which may appeal to breeders looking for additional flexibility in veterinary care.

Both providers offer robust network flexibility, but Spot’s inclusion of international coverage makes it more appealing for pet owners who prioritize travel-friendly insurance options.

Customer Reviews and Ratings

When comparing Spot Pet Insurance vs AKC Pet Insurance, it’s essential to consider customer reviews and ratings to gauge overall satisfaction and service quality. Below is an overview of each provider’s ratings from Trustpilot and the Better Business Bureau (BBB).

Spot Pet Insurance

- Trustpilot: Spot holds a TrustScore of 4.7 out of 5, based on over 5,000 reviews, indicating a high level of customer satisfaction. Many users praise the company’s swift claims processing and user-friendly mobile app. Insurify

- Better Business Bureau (BBB): Spot is accredited by the BBB with an A rating. Customer reviews on the BBB website average around 3 stars, with some users expressing concerns about claim denials and communication issues. Insurify

AKC Pet Insurance

- Trustpilot: AKC Pet Insurance has a TrustScore of 4.4 out of 5, based on over 1,000 reviews. Customers often commend the company’s responsive customer service and efficient claims handling. Insurify

- Better Business Bureau (BBB): The administrator of AKC Pet Insurance, PetPartners, Inc., holds an A+ rating with the BBB. However, there are limited customer reviews available on the BBB platform, making it challenging to assess user satisfaction fully. This Old House

Key Takeaways

- Customer Satisfaction: Both providers receive generally positive feedback, with Spot slightly ahead in Trustpilot ratings.

- BBB Accreditation: Both companies are accredited with high BBB ratings, reflecting a commitment to resolving customer complaints and maintaining trust.

- Areas of Improvement: Some customers have reported issues with claim denials and communication for both providers, highlighting the importance of thoroughly understanding policy terms and maintaining clear communication with the insurer.

Company Reputation and Longevity

When comparing Spot Pet Insurance vs AKC Pet Insurance, evaluating company reputation and longevity is crucial. These factors provide insights into each provider’s reliability, industry standing, and ability to meet customer needs over time.

Spot Pet Insurance

Spot Pet Insurance is a relatively new player in the pet insurance industry, having been established in 2019. Despite its recent entry, Spot has quickly gained a strong reputation, thanks in part to its collaboration with dog behavior expert Cesar Millan. Key highlights include:

- Reputation: Spot has become known for its customer-centric approach, offering flexible and customizable plans to pet owners. Its focus on transparency and user-friendly tools has contributed to its positive image.

- Industry Backing: Although newer, Spot is underwritten by United States Fire Insurance Company, a financially stable and well-established entity in the insurance industry.

- Growth: Spot has rapidly gained market share due to its modern approach and competitive offerings, making it a trusted name among pet owners.

AKC Pet Insurance

AKC Pet Insurance has a much longer history, as it was founded in 2003 as a division of the American Kennel Club (AKC). This longevity gives it a significant advantage in terms of experience and trustworthiness. Key highlights include:

- Reputation: Backed by the AKC, a highly respected organization in the pet industry, AKC Pet Insurance is often associated with quality and reliability.

- Industry Ties: AKC’s connection to breeders and dog owners provides a unique niche, making it a top choice for pet owners seeking breeder-specific options.

- Stability: The company’s long-standing presence and affiliation with the AKC ensure it has the expertise and resources to support its customers.

Key Differences in Reputation and Longevity

- Establishment Year: Spot is newer (established in 2019) compared to AKC’s 2003 founding. AKC’s longevity provides a stronger track record.

- Market Position: Spot has quickly gained recognition for its modern and customizable plans, while AKC leverages its longstanding reputation and ties to the pet community.

- Backing: Both companies are backed by reputable underwriters, ensuring financial stability and trustworthiness.

When comparing Spot Pet Insurance vs AKC, Spot excels as a modern, customer-focused provider, while AKC stands out for its long history, established reputation, and connection to the pet community.

Special Features or Perks

When comparing Spot Pet Insurance vs AKC Pet Insurance, special features or perks can make one provider stand out over the other. These unique benefits may include partnerships, add-ons, or tools that enhance the overall insurance experience.

Spot Pet Insurance Special Features or Perks

Spot Pet Insurance offers several standout features designed to provide added value to pet owners:

- Collaboration with Cesar Millan: Spot is endorsed by the well-known dog behavior expert Cesar Millan, adding credibility and trust to its brand.

- Customizable Plans: Spot allows pet owners to adjust annual limits, deductibles, and reimbursement rates, ensuring maximum flexibility.

- Optional Wellness Plan: Spot’s wellness plan includes routine care like vaccinations, dental cleanings, and wellness exams, giving pet owners the option to bundle preventive care with accident and illness coverage.

- Unlimited Annual Coverage: Spot offers the option for unlimited annual coverage, making it ideal for pet owners seeking comprehensive protection without worrying about caps.

- Mobile App: Spot’s user-friendly app simplifies claims submissions, policy management, and tracking, making it a convenient choice for busy pet owners.

Spot’s perks make it an excellent choice for modern pet owners who value flexibility and user-friendly tools.

AKC Pet Insurance Special Features or Perks

AKC Pet Insurance also provides unique benefits, particularly for pet owners with ties to the American Kennel Club or those seeking breeder-specific coverage:

- Connection to the AKC: As the official pet insurance partner of the American Kennel Club, AKC offers exclusive perks for registered AKC members, including discounts and specialized services.

- Breeder Coverage Options: AKC provides unique add-ons for breeding-related costs, such as coverage for pregnancy, whelping, and genetic testing.

- Microchip Enrollment: AKC plans include the option to register your pet’s microchip with the AKC Reunite program, enhancing your pet’s safety.

- Exam Fee Coverage: AKC allows pet owners to add exam fee coverage, which is typically excluded from standard plans.

- Wellness Packages: AKC offers customizable wellness add-ons, allowing pet owners to tailor coverage for routine and preventive care.

AKC’s special features cater to pet owners who value the organization’s expertise and resources, particularly those involved in breeding or AKC registration.

Key Differences in Special Features or Perks

- Endorsements: Spot’s partnership with Cesar Millan appeals to pet owners familiar with his expertise, while AKC’s affiliation with the American Kennel Club provides added value for registered members.

- Breeding Coverage: AKC offers specialized breeding coverage, which Spot does not provide.

- Technology: Spot’s mobile app offers a more modern and convenient approach to policy management and claims, which AKC lacks.

When comparing Spot Pet Insurance vs AKC, Spot stands out for its modern tools and flexibility, while AKC excels in providing breeder-specific options and benefits for AKC members.

Which Pet Insurance is Right for You?

Choosing between Spot Pet Insurance vs AKC Pet Insurance depends on your pet’s specific needs, your budget, and your preferences for coverage and features. Both providers have strengths and cater to slightly different types of pet owners. Here’s how to decide which one might be the best fit for you.

Spot Pet Insurance: Who Is It Best For?

Spot Pet Insurance is ideal for pet owners looking for:

- Flexible and Customizable Coverage: Spot offers extensive customization options for annual limits, deductibles, and reimbursement rates, allowing you to tailor the plan to fit your budget and coverage needs.

- Comprehensive Wellness Plans: If routine care like vaccinations, dental cleanings, and wellness exams is a priority, Spot’s wellness add-on provides excellent value.

- Quick Accident Coverage: Spot’s short 2-day waiting period for accident coverage is one of the fastest in the industry, making it a great choice for immediate protection.

- Travel-Friendly Options: Spot covers treatments from licensed veterinarians in Canada, making it a better option for pet owners who travel frequently.

- Modern Tools: With its user-friendly mobile app and seamless claims process, Spot is perfect for tech-savvy pet owners.

If you want a modern, flexible pet insurance provider with options for comprehensive coverage, Spot is an excellent choice.

AKC Pet Insurance: Who Is It Best For?

AKC Pet Insurance is a great option for pet owners who:

- Are Connected to the AKC: If you’re an AKC member or breeder, the company’s exclusive perks, such as breeding coverage and discounts, may be particularly appealing.

- Need Breeder-Specific Coverage: AKC’s specialized add-ons for pregnancy, whelping, and genetic testing make it the go-to choice for breeders.

- Value Longevity and Reputation: With its affiliation to the American Kennel Club and over 20 years in the industry, AKC has a long-standing reputation for reliability.

- Want Customizable Wellness Packages: AKC allows you to tailor wellness add-ons to suit your pet’s routine care needs, though these plans may require careful selection.

- Prioritize Exam Fee Coverage: Unlike Spot, AKC offers an add-on specifically for exam fees, which can save money if you visit the vet frequently.

For pet owners tied to the AKC or those looking for breeder-specific features, AKC Pet Insurance provides unique benefits that set it apart.

Making the Right Choice

- Choose Spot if you prioritize flexibility, modern tools, and quick accident coverage. It’s perfect for most pet owners who want straightforward, customizable plans.

- Choose AKC if you are a breeder, an AKC member, or need coverage tied to breeding-related expenses. Its long-standing reputation and specialized options make it the better choice in these scenarios.

By understanding your pet’s needs and evaluating the unique features of each provider, you can make an informed decision between Spot Pet Insurance vs AKC.