When it comes to protecting your pet’s health and managing unexpected veterinary costs, choosing the right insurance provider is crucial. If you’re deciding between Nationwide Pet Insurance vs Pets Best, you’re already considering two of the top providers in the industry. Both companies offer robust coverage options, but their plans cater to different needs and preferences.

Nationwide is one of the longest-standing pet insurance providers and is renowned for its comprehensive plans, including coverage for exotic pets. On the other hand, Pets Best is known for its customizable options, fast claim processing, and tech-friendly features like a mobile app and 24/7 Vet Helpline.

This guide will break down the key features of Nationwide and Pets Best, comparing them across critical categories like coverage options, costs, waiting periods, and customer satisfaction. By the end, you’ll have a clear understanding of which provider suits your pet and budget best.

With this comprehensive comparison, you can feel confident in choosing the pet insurance provider that ensures your furry, feathered, or scaly friend gets the care they deserve.

Table of Contents

Coverage Options

When comparing Nationwide Pet Insurance vs Pets Best, one of the most critical factors is the range of coverage options available. Both companies offer a variety of plans tailored to meet different pet owners’ needs, but there are significant differences to consider.

Nationwide Pet Insurance Coverage

Nationwide is one of the few providers offering coverage for exotic pets in addition to cats and dogs, making it a standout choice for owners of reptiles, birds, and small mammals. Their coverage options include:

- Whole Pet with Wellness: A comprehensive plan covering accidents, illnesses, hereditary conditions, and wellness care like vaccinations and dental cleanings.

- Major Medical: Covers major accidents and illnesses but excludes wellness and routine care.

- Pet Wellness: A standalone wellness plan that covers preventive care, including flea and tick prevention, vaccinations, and spaying/neutering.

Pets Best Coverage

Pets Best focuses exclusively on cats and dogs and offers more customizable plans. Their coverage options include:

- Essential Plan: Covers accidents and illnesses but excludes routine care.

- Plus Plan: Adds coverage for rehabilitation, acupuncture, and chiropractic care.

- Elite Plan: Includes all features of the Plus Plan, plus exam fees and alternative therapies.

- Routine Care Add-On: Can be added to any plan for coverage of wellness services like vaccinations and microchipping.

Key Differences

- Exotic Pet Coverage: Nationwide has a clear advantage here, as Pets Best does not offer plans for exotic pets.

- Customization: Pets Best provides more flexibility with deductibles, reimbursement rates, and annual limits, allowing pet owners to tailor their plans to fit their budget.

- Comprehensive Coverage: Nationwide’s Whole Pet with Wellness is among the most comprehensive plans on the market but comes at a higher cost.

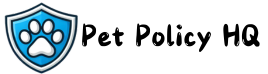

Cost and Premiums

Understanding the cost and premiums is essential when deciding between Nationwide Pet Insurance vs Pets Best. Both providers offer varying pricing structures depending on factors like the pet’s age, breed, and location, but there are key distinctions that may influence your decision.

Nationwide Pet Insurance Costs

Nationwide’s premiums tend to be on the higher end, particularly for their Whole Pet with Wellness plan. This is due to the comprehensive nature of the coverage, which includes both major medical expenses and preventive care. Here’s what impacts Nationwide’s pricing:

- Plan Type: The Whole Pet with Wellness plan is more expensive, while the Major Medical plan is more budget-friendly.

- Exotic Pets: Coverage for exotic pets can be costly due to the specialized care required.

- Flat Rates: Nationwide often uses flat rates that don’t vary as much by breed, making it potentially more cost-effective for high-risk breeds.

Pets Best Costs

Pets Best is known for offering affordable and customizable premiums, making it a popular choice for budget-conscious pet owners. Here’s what to expect:

- Customizable Plans: Pet owners can adjust deductibles, annual limits, and reimbursement rates to control premium costs.

- Add-On Options: Adding wellness coverage increases premiums but allows more flexibility than Nationwide’s bundled options.

- Breed and Age Factors: Premiums vary significantly by breed and age, so younger pets or low-risk breeds typically cost less.

Key Differences

- Flexibility: Pets Best allows greater control over premium costs through plan customization, while Nationwide offers more standardized pricing.

- Routine Care Costs: Nationwide’s bundled wellness care can make premiums higher, while Pets Best’s optional add-ons provide a more modular approach.

- Exotic Pet Coverage: Nationwide is one of the few providers offering coverage for exotic pets, which may justify higher premiums for those owners.

Deductibles and Reimbursement Rates

When comparing Nationwide Pet Insurance vs Pets Best, understanding the deductibles and reimbursement rates is crucial. These factors directly affect out-of-pocket costs and the overall affordability of your pet insurance plan.

Nationwide Pet Insurance Deductibles and Reimbursement Rates

Nationwide follows a fixed deductible model:

- Deductibles: Nationwide typically has a fixed $250 annual deductible across most plans. This simplifies budgeting but offers less flexibility for cost control.

- Reimbursement Rates: Nationwide reimburses a set percentage, often around 70% to 90%, depending on the plan.

- Caps on Payouts: Some plans, such as Major Medical, have benefit caps based on a predetermined schedule for specific conditions.

This straightforward structure is ideal for pet owners who prefer predictability in their insurance costs but may be limiting for those who want to customize their expenses.

Pets Best Deductibles and Reimbursement Rates

Pets Best provides customizable options, making it a more flexible choice:

- Deductibles: Pet owners can choose from a range of annual deductibles, typically from $50 to $1,000. This allows for premium adjustments to suit different budgets.

- Reimbursement Rates: Pets Best offers flexible reimbursement rates, including 70%, 80%, or 90%. Higher reimbursement rates increase premiums, while lower rates reduce costs.

- Annual Limits: Pets Best allows customization of annual limits, ranging from $5,000 to unlimited, giving pet owners more control over potential payouts.

This level of flexibility is beneficial for those looking to balance monthly premium costs with the potential reimbursement amounts.

Key Differences

- Customization: Pets Best excels in offering a wide range of deductibles and reimbursement rates, allowing pet owners to tailor plans to their needs and budget. Nationwide’s fixed structure provides simplicity but less adaptability.

- Payout Caps: Nationwide’s Major Medical plan has condition-specific payout limits, whereas Pets Best plans often feature broader or unlimited coverage.

- Budget Control: Pets Best allows pet owners to lower premiums by increasing deductibles or choosing lower reimbursement rates.

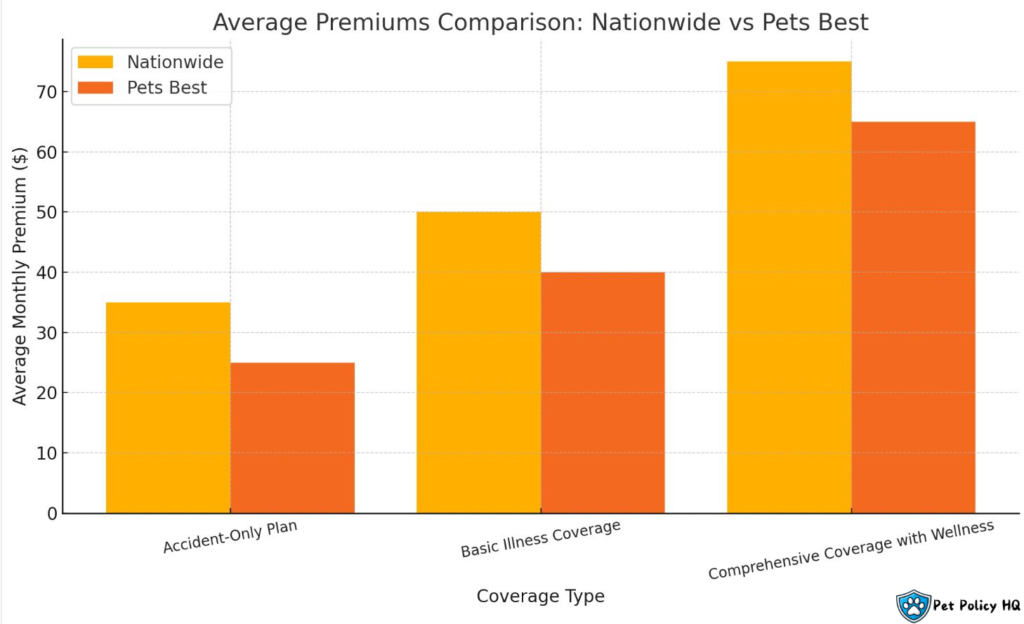

Claim Processing and Payout Speed

When deciding between Nationwide Pet Insurance vs Pets Best, the speed and efficiency of claim processing are crucial factors. Pet owners want a hassle-free experience when filing claims and receiving reimbursements, especially during stressful times when their pet needs medical care.

Nationwide Pet Insurance

Nationwide offers a straightforward claims process but tends to have longer payout times compared to some competitors:

- Claim Submission: Claims can be submitted online, through email, or via mail. However, Nationwide does not currently have a mobile app for claims submission, which could be a drawback for tech-savvy pet owners.

- Processing Time: Claims are typically processed within 14-30 days, depending on the complexity of the case.

- Reimbursement Method: Reimbursements are issued via check or direct deposit, depending on the preference set by the policyholder.

Pets Best

Pets Best is known for its fast and efficient claim processing, making it a preferred choice for pet owners who prioritize quick reimbursements:

- Claim Submission: Claims can be filed online, through the Pets Best mobile app, or by email, providing multiple convenient options.

- Processing Time: Claims are usually processed within 5-7 days, with many routine claims resolved in under a week.

- Reimbursement Method: Pets Best offers direct deposit as a standard option, which is faster and more convenient than waiting for a mailed check.

Key Differences

- Speed: Pets Best has a significant edge in processing time, often reimbursing pet owners within a week, compared to Nationwide’s longer 14-30 day timeline.

- Convenience: Pets Best’s mobile app allows for easy claim submission and tracking, whereas Nationwide relies on traditional methods like email or mail.

- Consistency: Both companies offer reliable reimbursement, but Pets Best’s quicker turnaround can be a deciding factor for time-sensitive claims.

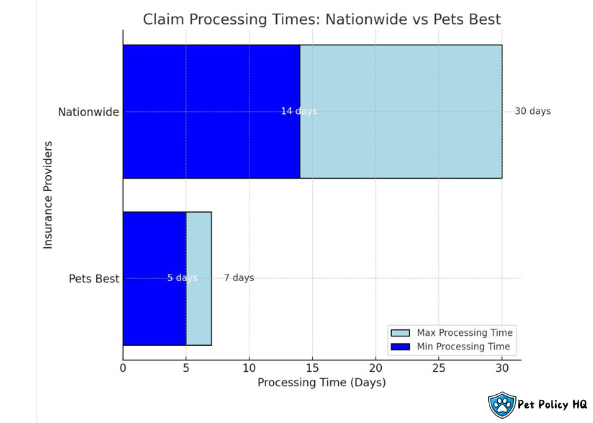

Customer Reviews and Satisfaction

Customer reviews provide critical insights into the real-world experiences of pet owners. When comparing Nationwide Pet Insurance vs Pets Best, Trustpilot ratings highlight the strengths and weaknesses of each provider, particularly regarding claim handling and customer service.

Nationwide Pet Insurance

Nationwide’s reviews reflect a mix of satisfaction and challenges, with its Trustpilot rating revealing room for improvement:

- Trustpilot Rating: Nationwide has an average score of 3.0 out of 5 stars on Trustpilot, indicating moderate customer satisfaction.

- Positive Feedback: Customers often praise Nationwide for its broad coverage options, including exotic pets, which few other insurers provide. Many also appreciate the inclusion of wellness coverage in its comprehensive plans.

- Common Complaints: Negative reviews frequently cite slow claim processing times (14-30 days) and occasional frustration with reimbursement caps. Some customers report difficulty resolving issues through customer support.

Pets Best

Pets Best has a stronger reputation for customer satisfaction, reflected in its Trustpilot score:

- Trustpilot Rating: Pets Best holds an average of 3.9 out of 5 stars on Trustpilot, showing generally positive reviews.

- Positive Feedback: Customers commend Pets Best for its fast claim processing, usually within 5-7 days, and the convenience of its mobile app for policy management and claim submission. The 24/7 Vet Helpline is another feature that receives high praise.

- Common Complaints: Some pet owners express concerns about premium increases over time and claim denials related to pre-existing conditions. These issues are noted but are less frequent than with other providers.

Key Differences

- Trustpilot Ratings: Pets Best (3.9) significantly outperforms Nationwide (3.0), indicating higher overall satisfaction.

- Claim Handling: Pets Best is frequently praised for its speed and efficiency, while Nationwide’s slower processing times often lead to customer frustration.

- Unique Features: Pets Best’s mobile app and 24/7 Vet Helpline provide added convenience, whereas Nationwide stands out for its comprehensive plans and exotic pet coverage.

By comparing customer reviews and Trustpilot ratings, it’s clear that Pets Best leads in customer satisfaction, thanks to its quick claims and user-friendly tools. Nationwide remains a strong contender for those needing exotic pet coverage or bundled wellness options.

Network and Veterinary Choice

When comparing Nationwide Pet Insurance vs Pets Best, one important factor to consider is whether you can use your preferred veterinarian or if you are restricted to a network. Both companies offer significant flexibility, but there are differences in how they approach veterinary choice.

Nationwide Pet Insurance

Nationwide offers a broad network of veterinary options, providing pet owners with substantial freedom:

- No Network Restrictions: Nationwide allows you to visit any licensed veterinarian, specialist, or emergency clinic in the United States. This includes options for exotic pet care, which can be more challenging to find.

- Exotic Pet Care: For those with birds, reptiles, or small mammals, Nationwide’s coverage applies to exotic animal specialists, making it one of the few providers catering to this need.

- International Coverage: Nationwide extends its coverage to some international veterinarians, which can be beneficial for frequent travelers.

Pets Best

Pets Best also offers an open network approach, ensuring pet owners have the freedom to choose their veterinarian:

- Licensed Veterinarians: Pets Best policies cover care from any licensed veterinarian, specialist, or emergency clinic in the United States.

- International Coverage: Pets Best goes a step further by including coverage for licensed veterinarians in Canada and Puerto Rico, providing added flexibility for pet owners who travel across borders.

- Additional Options: Pets Best includes a 24/7 Vet Helpline, allowing policyholders to consult with veterinary professionals for advice without visiting a clinic.

Key Differences

- Exotic Pet Coverage: Nationwide has the edge for exotic pet owners, offering coverage for specialists, while Pets Best is limited to cats and dogs.

- International Reach: Pets Best slightly outperforms Nationwide by covering veterinarians in Canada and Puerto Rico, making it ideal for frequent cross-border travelers.

- Support Services: Pets Best’s 24/7 Vet Helpline provides an extra layer of convenience and accessibility for pet owners.

Both Nationwide and Pets Best offer the flexibility to use your preferred veterinarian, but the decision ultimately comes down to your specific needs, such as exotic pet care or international travel coverage.

Wellness Plans

When comparing Nationwide Pet Insurance vs Pets Best, wellness plans play a key role for pet owners looking to cover routine and preventive care. These plans can save you money on regular veterinary expenses, such as vaccinations, check-ups, and dental cleanings. Both Nationwide and Pets Best offer wellness options, but they differ in structure and coverage.

Nationwide Pet Insurance

Nationwide includes wellness coverage as part of its comprehensive plan or as a standalone option:

- Whole Pet with Wellness: This plan combines accident, illness, and wellness coverage into one package. It covers routine care like vaccinations, spaying/neutering, flea prevention, and dental cleanings.

- Standalone Wellness Plan: For pet owners who only want preventive care, Nationwide offers a wellness-specific plan that covers basic and advanced care services.

- Exotic Pets: Nationwide’s wellness coverage extends to exotic pets, making it a unique option for owners of reptiles, birds, and small mammals.

- Cost: Wellness coverage is typically included in higher-tier plans, which may result in higher premiums compared to Pets Best’s add-on options.

Pets Best

Pets Best offers wellness plans as optional add-ons, providing flexibility for pet owners who want to customize their coverage:

- EssentialWellness Plan: Covers routine care like vaccinations, spaying/neutering, and microchipping. This plan has a lower cap for reimbursements.

- BestWellness Plan: Offers higher reimbursement limits for the same services as the EssentialWellness Plan, making it ideal for pet owners with higher preventive care expenses.

- Customizable: Since wellness coverage is an add-on, pet owners can choose whether or not to include it in their plan, helping control overall premiums.

- No Deductibles: Unlike accident and illness claims, wellness claims with Pets Best do not require deductibles, making reimbursements faster and simpler.

Key Differences

- Inclusion: Nationwide bundles wellness coverage into specific plans, while Pets Best offers it as an optional add-on, giving more flexibility to pet owners.

- Exotic Pets: Nationwide is the clear winner for exotic pet wellness coverage, as Pets Best only covers cats and dogs.

- Cost and Customization: Pets Best’s wellness add-ons allow for more affordable and tailored plans, whereas Nationwide’s bundled approach might be better for those seeking comprehensive coverage.

By evaluating the wellness plan options, pet owners can determine which provider aligns with their budget and routine care needs. Whether you’re looking for comprehensive coverage or flexible add-ons, both Nationwide and Pets Best have appealing options to consider.

Pre-Existing Conditions Policy

When deciding between Nationwide Pet Insurance vs Pets Best, understanding their policies on pre-existing conditions is essential. Both companies, like most pet insurance providers, exclude pre-existing conditions from coverage, but their approaches to defining and handling these conditions differ slightly.

Nationwide Pet Insurance

Nationwide has a more traditional approach to pre-existing conditions:

- Definition: Pre-existing conditions are defined as any illness, injury, or symptom that occurred before the policy’s effective date or during the waiting period.

- Curable Conditions: Nationwide does not cover any pre-existing conditions, even if they are curable. This means that once a condition is identified, it is permanently excluded from coverage.

- Claims Transparency: Nationwide provides detailed explanations for claim denials related to pre-existing conditions, which helps pet owners understand their coverage limits.

Pets Best

Pets Best is slightly more flexible when it comes to pre-existing conditions:

- Definition: Similar to Nationwide, Pets Best defines pre-existing conditions as any health issues or symptoms present before the policy’s start date or during the waiting period.

- Curable Conditions: Unlike Nationwide, Pets Best makes an exception for curable pre-existing conditions. If the pet goes symptom-free and treatment-free for 12 months, those conditions may be eligible for future coverage.

- Transparency and Support: Pets Best clearly outlines which conditions are excluded or may become eligible again, giving pet owners more clarity and peace of mind.

Key Differences

- Curable Conditions: Pets Best offers the opportunity to cover curable pre-existing conditions after a symptom-free period, whereas Nationwide permanently excludes them.

- Policy Transparency: Both companies are transparent about their pre-existing conditions policies, but Pets Best’s flexibility makes it a better choice for pet owners whose pets have previously recovered from temporary conditions.

By comparing the pre-existing conditions policies of Nationwide and Pets Best, pet owners can better evaluate which provider offers the best fit for their pet’s unique health history and future needs.

Waiting Periods

The waiting period is the time frame after purchasing a policy during which certain conditions or treatments are not covered. When comparing Nationwide Pet Insurance vs Pets Best, understanding their waiting periods is essential, as these can impact how soon your pet is eligible for coverage.

Nationwide Pet Insurance

Nationwide has standard waiting periods that align with most industry norms:

- Accident Coverage: A short 14-day waiting period applies before accidents are eligible for coverage.

- Illness Coverage: Similar to accident coverage, illnesses also have a 14-day waiting period.

- Orthopedic Conditions: Some plans may include a longer waiting period for specific conditions, though details are typically outlined in the policy terms.

- Exotic Pets: Nationwide applies the same waiting period for exotic pets as for cats and dogs, which is helpful for exotic pet owners seeking quick coverage.

Pets Best

Pets Best offers slightly shorter waiting periods for accident coverage, providing faster protection for unexpected events:

- Accident Coverage: A 3-day waiting period for accidents makes Pets Best one of the quicker options for pet owners needing immediate coverage.

- Illness Coverage: Pets Best has a 14-day waiting period for illnesses, similar to Nationwide.

- Cruciate Ligament and Related Conditions: A longer 6-month waiting period applies for cruciate ligament injuries and other orthopedic issues, though this can be reduced with a vet’s waiver.

- Optional Add-Ons: Wellness plans have no waiting period, allowing pet owners to start using preventive care benefits immediately after enrollment.

Key Differences

- Accident Waiting Period: Pets Best’s 3-day waiting period for accidents is significantly shorter than Nationwide’s 14-day period, making it ideal for pet owners seeking quicker coverage.

- Orthopedic Conditions: Both providers have extended waiting periods for orthopedic issues, but Pets Best offers the option to reduce this time with a vet’s waiver.

- Wellness Coverage: Pets Best does not impose a waiting period for wellness add-ons, while Nationwide includes wellness as part of its broader plan with standard waiting periods.

By comparing waiting periods, pet owners can determine which provider best meets their needs for timely coverage. Pets Best’s shorter waiting period for accidents and no waiting period for wellness plans may appeal to those looking for faster benefits, while Nationwide offers consistent timelines across all plans.

Multi-Pet Discounts and Other Benefits

For pet owners with multiple furry (or feathered) companions, saving on premiums can be a significant factor when choosing between Nationwide Pet Insurance vs Pets Best. Both providers offer multi-pet discounts, but their approach and additional benefits differ.

Nationwide Pet Insurance

Nationwide provides attractive benefits for multi-pet households and unique perks:

- Multi-Pet Discount: Nationwide offers a 5% discount for insuring more than one pet. This applies to all types of pets, including exotic animals, which makes it a rare option for those with non-traditional pets like birds, reptiles, or small mammals.

- Exotic Pet Coverage: Nationwide stands out by offering coverage for exotic pets, which is unavailable with many competitors, including Pets Best.

- Additional Benefits: Nationwide’s Whole Pet with Wellness plan includes routine care coverage, providing added value for comprehensive care.

Pets Best

Pets Best also caters to multi-pet households with flexible discounts and unique services:

- Multi-Pet Discount: Pets Best offers a 5% discount for each additional pet insured under the same policyholder. While similar to Nationwide’s discount, it is limited to cats and dogs only.

- 24/7 Vet Helpline: A standout feature of Pets Best is its 24/7 Vet Helpline, which allows pet owners to consult with veterinary professionals at any time for health advice, saving time and money on unnecessary clinic visits.

- Flexible Add-Ons: Pets Best provides optional wellness add-ons and highly customizable plans, enabling pet owners to tailor their coverage based on their specific needs and budget.

Key Differences

- Eligibility for Discounts: Nationwide extends multi-pet discounts to exotic pet owners, while Pets Best limits them to cats and dogs.

- Extra Benefits: Pets Best’s 24/7 Vet Helpline provides added convenience for quick veterinary advice, whereas Nationwide focuses on comprehensive coverage options, especially for exotic pets.

- Customization: Pets Best offers more flexible plan options and add-ons, giving pet owners control over what benefits to include in their policy.

With these insights, multi-pet owners can decide which provider offers the best value and benefits for their household. Whether it’s the exotic pet coverage with Nationwide or the convenience of Pets Best’s 24/7 Vet Helpline, both companies have appealing options to consider.

Exclusions and Limitations

When comparing Nationwide Pet Insurance vs Pets Best, it’s important to understand what is not covered by their policies. Exclusions and limitations outline the conditions and treatments that are ineligible for reimbursement, helping pet owners avoid surprises when filing claims.

Nationwide Pet Insurance

Nationwide has standard exclusions but also unique limitations based on its coverage options:

- Pre-Existing Conditions: Like most insurers, Nationwide does not cover pre-existing conditions. Any illness, injury, or symptom that occurred before the policy start date or during the waiting period is excluded.

- Cosmetic and Elective Procedures: Nationwide excludes non-medical procedures like tail docking, ear cropping, and declawing unless deemed medically necessary.

- Routine Exclusions: Breeding or pregnancy-related costs, as well as organ transplants, are not covered under most plans.

- Benefit Caps: Some plans, like Major Medical, have condition-specific benefit caps, meaning there is a maximum payout for certain illnesses or injuries.

Pets Best

Pets Best has similar exclusions but offers more transparency and flexibility in certain areas:

- Pre-Existing Conditions: Pets Best excludes pre-existing conditions, but curable pre-existing conditions may become eligible for coverage after 12 months without symptoms or treatment.

- Behavioral and Elective Treatments: Costs related to behavioral training or elective procedures are not covered.

- Breeding and Pregnancy: Like Nationwide, Pets Best excludes expenses related to breeding, pregnancy, or birth complications.

- Orthopedic Limitations: Pets Best imposes a 6-month waiting period for cruciate ligament injuries, though this can be waived with a vet’s certification.

Key Differences

- Condition-Specific Caps: Nationwide’s condition-specific benefit caps on certain plans may limit payouts, while Pets Best does not impose similar caps.

- Curable Pre-Existing Conditions: Pets Best’s policy for covering curable pre-existing conditions after a 12-month waiting period provides more flexibility compared to Nationwide’s permanent exclusion.

- Orthopedic Injuries: Pets Best includes a longer waiting period for orthopedic conditions, but it offers a waiver option that Nationwide does not.

Understanding exclusions and limitations helps pet owners choose a policy that aligns with their pet’s needs. Pets Best’s flexibility in handling curable pre-existing conditions and the absence of condition-specific caps make it a strong contender, while Nationwide’s broader coverage options, especially for exotic pets, cater to a different audience.

Ease of Enrollment

When comparing Nationwide Pet Insurance vs Pets Best, the enrollment process is a critical factor for pet owners who value convenience and simplicity. Both companies aim to make signing up for coverage as straightforward as possible, but there are notable differences in their approaches.

Nationwide Pet Insurance

Nationwide offers a user-friendly but slightly traditional enrollment experience:

- Online Enrollment: Pet owners can easily enroll through Nationwide’s website by selecting a plan, entering their pet’s details, and receiving a quote. The process is intuitive but less dynamic compared to Pets Best.

- Exotic Pet Coverage: Nationwide simplifies the enrollment process for exotic pets, a unique feature not offered by many competitors. Owners of birds, reptiles, or small mammals can quickly find and apply for coverage tailored to their needs.

- Limitations: Nationwide does not currently offer a mobile app for enrollment, which might feel outdated to tech-savvy users who prefer on-the-go access.

Pets Best

Pets Best excels in providing a streamlined and modern enrollment process:

- Flexible Online Tools: The website allows pet owners to customize plans by adjusting deductibles, annual limits, and reimbursement rates during enrollment. This flexibility makes it easy to create a policy tailored to specific needs and budgets.

- Mobile App: Pets Best’s mobile app supports enrollment, making it convenient for pet owners to sign up and manage policies anytime, anywhere.

- Quick Quotes: Pets Best generates instant quotes after pet details are entered, helping owners compare options and make quick decisions.

Key Differences

- Customization: Pets Best’s enrollment process allows for more plan customization, enabling pet owners to adjust coverage options during sign-up. Nationwide offers less flexibility but simplifies the process for exotic pet owners.

- Technology: Pets Best stands out with its mobile app for enrollment and management, while Nationwide relies on a more traditional web-based system.

- Specialized Coverage: Nationwide’s ease of enrollment for exotic pets is a unique feature that sets it apart for those with non-traditional animals.

Both Nationwide and Pets Best provide straightforward enrollment processes, but Pets Best’s emphasis on technology and customization makes it a better choice for pet owners seeking flexibility and convenience. Meanwhile, Nationwide’s specialized support for exotic pets makes it a standout for those with more unique coverage needs.

Unique Selling Points

When comparing Nationwide Pet Insurance vs Pets Best, each provider has distinct features that set it apart from competitors. These unique selling points can help pet owners decide which insurance provider best aligns with their needs and priorities.

Nationwide Pet Insurance

Nationwide’s unique selling points cater to a broader range of pet owners, including those with exotic pets:

- Exotic Pet Coverage: Nationwide is one of the only pet insurance providers that covers exotic animals like birds, reptiles, and small mammals. This makes it a top choice for non-traditional pet owners.

- Comprehensive Wellness Plans: Nationwide’s Whole Pet with Wellness plan offers integrated coverage for accidents, illnesses, and preventive care, making it one of the most comprehensive plans available.

- Flat-Rate Pricing: Nationwide’s plans feature flat-rate pricing for certain conditions and treatments, which can be advantageous for owners of higher-risk breeds.

- Established Reputation: As one of the first pet insurance providers in the U.S., Nationwide has a long-standing reputation for reliability and trustworthiness.

Pets Best

Pets Best appeals to pet owners who prioritize customization, technology, and speed:

- Customizable Plans: Pets Best offers highly flexible options, allowing pet owners to adjust deductibles, reimbursement rates, and annual limits to fit their budget and coverage needs.

- Fast Claim Processing: Pets Best is known for its efficient claim process, with many claims processed within 5-7 days, significantly faster than Nationwide.

- 24/7 Vet Helpline: Pets Best includes a 24/7 Vet Helpline, giving pet owners access to professional advice at any time, which can save money on unnecessary vet visits.

- Mobile App: The Pets Best mobile app simplifies policy management, claim submissions, and enrollment, making it a convenient option for tech-savvy pet owners.

Key Differences

- Target Audience: Nationwide is ideal for pet owners with exotic pets or those seeking comprehensive wellness plans. Pets Best caters to pet owners who want fast claims, plan flexibility, and cutting-edge technology.

- Added Features: Pets Best’s 24/7 Vet Helpline and mobile app offer additional value, while Nationwide’s focus on exotic pet coverage makes it a standout for non-traditional pets.

By highlighting these unique selling points, pet owners can better determine which provider offers the features most important to them, whether it’s comprehensive wellness coverage or innovative tools for managing their policy.

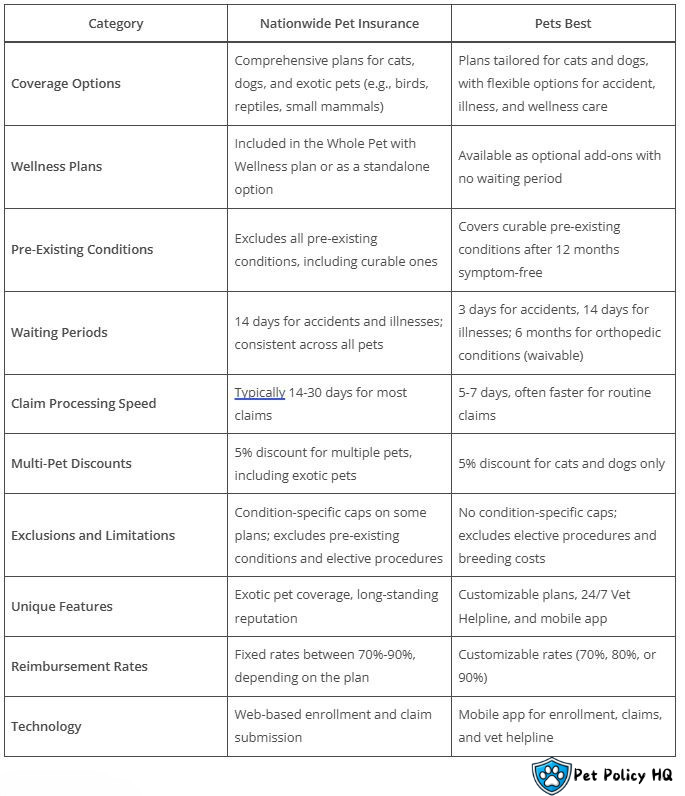

Final Comparison Table

To provide a clear summary of Nationwide Pet Insurance vs Pets Best, we’ve created a side-by-side comparison table that highlights their key features, benefits, and differences. This table allows pet owners to quickly assess which provider aligns best with their needs.

This final comparison table provides a concise overview of Nationwide and Pets Best, helping pet owners identify which insurance provider is best suited to their pet’s needs, budget, and lifestyle.

Conclusion and Recommendation

Choosing between Nationwide Pet Insurance vs Pets Best depends on your pet’s specific needs, your budget, and the features you prioritize most in an insurance provider. Both companies offer solid coverage options, but their unique strengths cater to different types of pet owners.

Nationwide Pet Insurance: Best for Exotic Pet Owners and Comprehensive Coverage

Nationwide is a standout choice for pet owners with exotic animals, as it’s one of the few providers that includes coverage for birds, reptiles, and small mammals. Its Whole Pet with Wellness plan is ideal for those seeking an all-in-one package that covers accidents, illnesses, and preventive care. However, its longer claim processing times and lack of curable pre-existing condition coverage may be drawbacks for some.

Pets Best: Best for Fast Claims and Customization

Pets Best is perfect for pet owners who value flexibility and speed. Its 3-day waiting period for accidents, customizable plans, and 24/7 Vet Helpline make it a convenient and affordable choice. Additionally, its policy of covering curable pre-existing conditions after 12 months provides a level of flexibility not offered by Nationwide. However, it doesn’t cover exotic pets, which limits its appeal for those with non-traditional animals.

Our Recommendation

- Choose Nationwide if: You have exotic pets or want a comprehensive plan that bundles wellness and medical coverage. Nationwide is also a great option for pet owners who value stability and a long-standing reputation.

- Choose Pets Best if: You want fast claim processing, the ability to customize your plan, or access to tech-friendly features like a mobile app and 24/7 Vet Helpline. It’s particularly suitable for budget-conscious owners of cats and dogs.

Both Nationwide and Pets Best are excellent providers with distinct advantages. By weighing their strengths against your specific needs, you can confidently choose the pet insurance plan that ensures your furry (or feathered) friend receives the care they deserve.