Overview of Pumpkin and Spot Pet Insurance

If you’re comparing Pumpkin vs Spot Pet Insurance to find the best policy for your pet, you’re in the right place. Both providers are highly regarded in the industry but cater to different needs. Pumpkin Pet Insurance emphasizes comprehensive coverage, including wellness care, making it ideal for proactive pet owners. On the other hand, Spot Pet Insurance offers unmatched flexibility, allowing pet owners to tailor their coverage and premiums to fit their budget and lifestyle.

In this guide, we’ll explore how these two providers stack up in terms of coverage, pricing, claims process, and unique features, so you can confidently choose the right insurance for your furry friend.

Introduction to Pumpkin Pet Insurance

Pumpkin Pet Insurance is a relatively new player in the pet insurance landscape, having been established in 2020. It aims to provide comprehensive coverage for pets, focusing on the health and well-being of dogs and cats. With a user-friendly platform and a commitment to transparency, Pumpkin is quickly gaining traction among pet owners seeking reliable insurance solutions. The company prides itself on offering policies that cover not just emergencies but also preventive care, ensuring that pet owners can maintain their animals’ health without breaking the bank.

Introduction to Spot Pet Insurance

On the other side, Spot Pet Insurance has been serving pet owners since 2019 and has quickly carved out a niche for itself. Spot offers customizable plans that cater to different needs and budgets, allowing pet owners to find a policy that fits their lifestyle. Its mission is to provide peace of mind for pet owners, knowing that their furry friends are covered in case of accidents or illnesses. Spot emphasizes both flexibility in coverage and straightforward claims processes, making it appealing to a wide range of pet owners.

Table of Contents

Types of Coverage Offered

Pumpkin Coverage Options

Pumpkin Pet Insurance offers two primary types of coverage: accident and illness plans. These plans cover a broad spectrum of veterinary costs, including diagnostic tests, surgeries, hospitalization, and medications. One of the standout features of Pumpkin is its inclusion of preventive care options, which cover routine check-ups, vaccinations, and even dental cleanings, making it a comprehensive choice for proactive pet owners. Additionally, Pumpkin provides an option for a wellness plan, which includes benefits like flea and tick prevention and annual wellness exams.

Spot Coverage Options

Spot Pet Insurance provides a flexible range of coverage options, notably its accident-only plans and more comprehensive accident and illness plans. Spot also allows pet owners to customize their plans by choosing their reimbursement percentage and annual deductible, which can help manage monthly premiums. Their wellness plans focus on preventive care, similar to Pumpkin’s offerings, covering routine visits, dental care, and vaccinations. This flexibility is a significant draw for pet owners looking for tailored coverage that meets their specific needs.

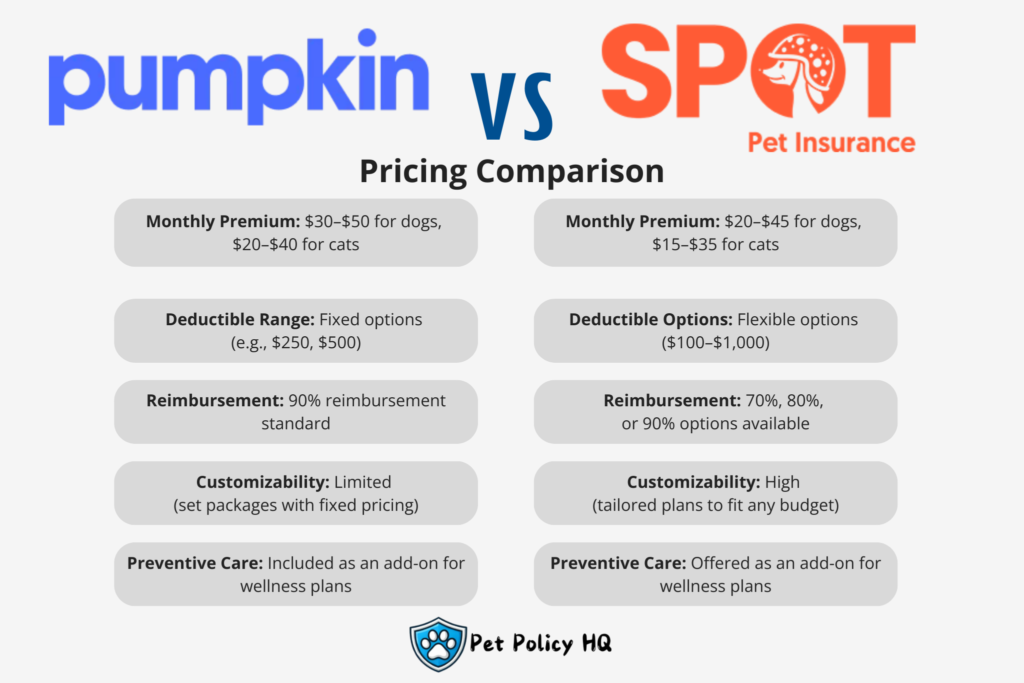

Pricing Comparison

Premiums Overview

When it comes to premiums, both Pumpkin and Spot Pet Insurance offer competitive pricing, but several factors can influence the final cost. Generally, Pumpkin’s monthly premiums tend to be slightly higher due to its extensive coverage options, including preventive care. However, many pet owners find the added benefits worth the investment, especially for proactive health management. Spot, on the other hand, offers a wider range of price points, making it accessible for pet owners on different budgets. Spot’s flexibility in customization can lead to lower premiums if certain add-ons are excluded.

Deductibles Comparison

Deductibles play a crucial role in determining the overall cost of pet insurance. Pumpkin typically offers a fixed deductible amount, which can be chosen at the outset of the policy. This means you’ll know exactly how much you need to pay out of pocket before your insurance kicks in. Spot Pet Insurance allows for more flexibility, letting pet owners choose between various deductible options, which can range from $100 to $1,000. This choice allows owners to balance their monthly premium with the out-of-pocket costs they are comfortable with, making it easier to fit pet insurance into their budgets.

Claim Filing Process and Payout Times

Pumpkin Claim Process

Pumpkin Pet Insurance prides itself on a straightforward claim filing process. Pet owners can submit claims online through their user-friendly website, which guides them through each step. Once a claim is submitted, Pumpkin typically processes it within a few days, with payouts being made via direct deposit. This efficient process is designed to minimize stress for pet owners during what can be a difficult time, allowing them to focus on their pet’s recovery rather than paperwork.

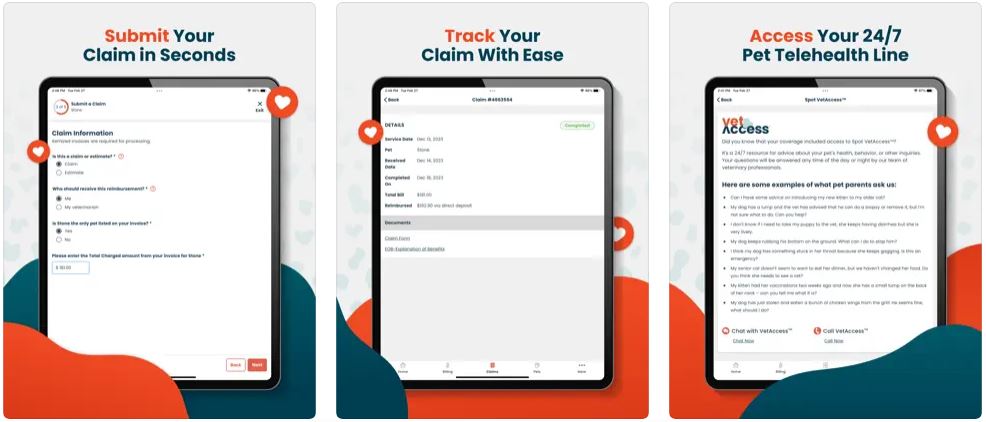

Spot Claim Process

Spot Pet Insurance has a similarly straightforward claims process, allowing claims to be filed online or via their app. Pet owners have the option to upload receipts and medical records directly through the platform. Spot is known for its rapid processing times, often resolving claims within just a few days. Additionally, they offer a feature called Spot’s “Quick Claims,” which allows for faster payouts on certain claims, ensuring pet owners receive their reimbursements quickly when they need it the most.

Unique Features or Perks

Pumpkin Unique Features

Pumpkin offers several unique features that set it apart from other pet insurance providers. For instance, their coverage for preventive care is comprehensive, including not just routine check-ups but also dental care and vaccinations. They also have a 90% reimbursement option, which can significantly ease the financial burden for pet owners during emergencies. Pumpkin’s commitment to transparency is evident in their clear policy documents and customer service, allowing pet owners to understand what their policy covers without any hidden surprises.

Spot Unique Features

Spot Pet Insurance boasts unique features such as its customizable plans that allow pet owners to choose their own reimbursement percentages and deductibles, making it a flexible option. Another standout feature is the absence of lifetime limits on claims, meaning that pets can be covered for multiple incidents without the risk of reaching a cap. Spot also provides educational resources through its platform, helping pet owners understand their policies better and encouraging responsible pet ownership through informative articles and tips.

Common Exclusions or Limitations

Pumpkin Exclusions

Like all insurance policies, Pumpkin Pet Insurance has certain exclusions that pet owners should be aware of. Pre-existing conditions are not covered, meaning any health issues your pet had before obtaining the policy will not be eligible for coverage. Additionally, Pumpkin does not provide coverage for routine wellness visits unless you opt for their specific wellness plan, which may lead to some confusion among new policyholders. It is essential for pet owners to thoroughly read and understand their policy documents to avoid any surprises when filing claims.

Spot Exclusions

Spot Pet Insurance also has its share of exclusions, primarily surrounding pre-existing conditions, which are not covered under any circumstances. Other exclusions can include certain behavioral treatments and elective procedures that are not deemed medically necessary. Spot is transparent about these exclusions in their policy documents, ensuring that pet owners know what to expect from their coverage. Understanding these limitations is vital in making an informed choice about which insurance policy best meets their needs.

Recommendations for Pet Owners

Who Should Choose Pumpkin?

Pumpkin Pet Insurance is an excellent choice for pet owners who prioritize comprehensive coverage and preventive care. If you’re someone who regularly takes their pet for check-ups, vaccinations, and dental treatments, opting for Pumpkin would provide peace of mind knowing that these costs are covered. Additionally, if you prefer a policy with a higher reimbursement rate and clear documentation, Pumpkin’s straightforward approach can simplify pet healthcare management.

Who Should Choose Spot?

Spot Pet Insurance is particularly appealing for pet owners looking for flexibility and customization. If you have a tight budget but still want to secure a policy that provides essential coverage for accidents and illnesses, Spot allows you to adjust your deductible and reimbursement rates accordingly. Furthermore, if you have pets with specific needs or pre-existing conditions, Spot’s lack of lifetime limits on claims can be a significant advantage, making it a solid choice for many pet owners.

Real-Life Customer Reviews

Pumpkin Customer Experiences

Customer reviews for Pumpkin Pet Insurance are generally positive, with many pet owners praising the ease of use of their platform and the speed of claim processing. Reviews often highlight the comprehensive nature of the coverage, particularly the wellness options that allow for more proactive pet health management. Some customers have noted that the premiums can be higher than competitors, but they feel the coverage received justifies the cost. Overall, Pumpkin has built a strong reputation for transparency and reliability among its users.

Spot Customer Experiences

Spot Pet Insurance also receives favorable reviews, with pet owners appreciating the customizable options available in their policies. Many customers have reported quick claim approvals and direct deposits, simplifying the reimbursement process. However, some have mentioned a desire for more clarity on certain exclusions. Despite this, the overall sentiment is that Spot provides a solid balance of coverage and affordability, making it a strong contender in the pet insurance market.

Final Recommendation

When considering Pumpkin and Spot Pet Insurance, both have unique advantages catering to different pet owner needs. Pumpkin is ideal for those seeking a comprehensive plan with extensive preventive care options, while Spot offers customization and flexibility that can suit various budgets. Ultimately, the best choice comes down to individual preferences and the specific needs of your pet. Regardless of your choice, both companies provide valuable coverage, ensuring that your furry friend receives the care they deserve.

FAQs

What factors should I consider when choosing pet insurance?

When choosing pet insurance, consider your pet’s age, health condition, and specific needs. Look at the types of coverage offered, premiums, deductibles, exclusions, and the claim process. It’s also beneficial to read customer reviews and compare different providers to find the best fit for you and your pet.

Is preventive care included in pet insurance plans?

Some pet insurance providers, like Pumpkin, include preventive care options in their plans, while others offer it as an add-on. It’s crucial to check the details of each policy to understand what preventive services are covered and whether additional costs are involved.

Are there waiting periods for pet insurance coverage?

Yes, most pet insurance policies have a waiting period before coverage begins. This period can vary between companies and typically ranges from a few days to several weeks, depending on the type of coverage. Understanding these waiting periods is essential before enrolling your pet in an insurance plan.

Can I switch pet insurance providers if I’m unhappy with my current plan?

You can switch pet insurance providers if you’re unhappy with your current plan. However, it’s advisable to thoroughly research potential new providers and their policies before making a switch. Additionally, be mindful of any waiting periods associated with your new policy and ensure your pet’s prior conditions are understood, as they may not be covered.

What should I do if my claim is denied?

If your claim is denied, review the denial reason provided by your insurance company. You can appeal the decision by submitting additional documentation or clarifying your policy’s coverage. If necessary, reach out to your insurance company’s customer service for assistance in resolving the issue.